The MBA Opens Doors Foundation yesterday welcomed Christine Chandler, MBA’s 2024 Vice Chair and Executive Vice President, Chief Credit Officer, and Chief Operating Officer at M&T Realty Capital Corporation, and Jeffrey C. Taylor, Founder & Managing Director at Mphasis Digital Risk, to its Board of Directors.

Category: News and Trends

MBA Appoints Victor Calanog of Manulife Investment Management Vice-Chair of 2024 Affordable Rental Housing Advisory Council; Announces Council Roster

The Mortgage Bankers Association is pleased to announce that Victor Calanog of Manulife Investment Management will serve as Vice-Chair of the 2024 Affordable Rental Housing Advisory Council.

CREF Policy Update March 7: MBA Statement on the House Passage of the FY 2024 Funding Package

Commercial and multifamily developments and activities from MBA important to your business and our industry.

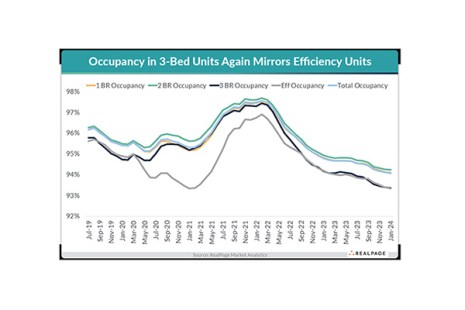

RealPage: Apartment Occupancy by Type Returning to Pre-Pandemic Norms

RealPage, Richardson, Texas, reported occupancy among unit types is rebounding to pre-COVID patterns. Specifically, three-bedroom unit occupancy–which hit record highs in 2021 and 2022–is softening.

Berkadia: Student Housing Fundamentals Still Strong, but Sales Environment Weaker

Berkadia, New York, released its 2024 U.S. Student Housing Market Report, finding student housing sales for 2023 fell 43% from 2022.

MBA NewsLink Q&A With Rice Park Capital Management’s Nick Smith and Chris Bixby

MBA NewsLink recently interviewed Nick Smith, Founder, Managing Partner and CEO of Rice Park Capital Management, Plymouth, Minn., and Managing Director of Strategic Equity Investing Chris Bixby about their perspectives on the mortgage industry.

MBA Opposes FFB Risk Sharing Program Extension; Calls on HUD to Address High Fees

MBA President and CEO Bob Broeksmit, CMB, released the following statement on the Biden administration’s housing announcements last week, which include extending indefinitely the Federal Housing Administration (FHA) and Federal Financing Bank (FFB) Risk Sharing program:

Seyfarth Shaw: CRE Industry Optimistic for 2024

Seyfarth Shaw, Chicago, released its Real Estate Market Sentiment Survey, finding 83% of commercial real estate executives have a buoyant outlook for the sector this year.

Dealmaker: X-Caliber Funding, CastleGreen Finance Complete $122M Refinance for Fairmont Breakers Long Beach Hotel

X-Caliber Funding and CastleGreen Finance, an X-Caliber affiliate that provides capital through Commercial Property Assessed Clean Energy financing, provided $122 million to refinance Long Beach, California’s Fairmont Breakers Hotel & Spa.

CMF Quote of the Week: Feb. 29, 2024

“The U.S. economy had stronger than expected growth in 2023, specifically in Q4, with a 3.3% growth rate, and that’s going to give us some momentum going into 2024.”

–Joel Kan, Vice President and Deputy Chief Economist with the Mortgage Bankers Association