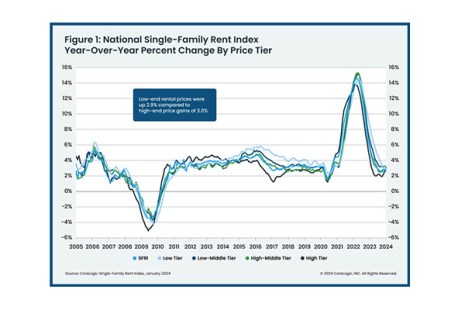

CoreLogic, Irvine, Calif., released its single-family rent index, showing single-family rental costs increased by 2.6% year-over-year in January.

Category: News and Trends

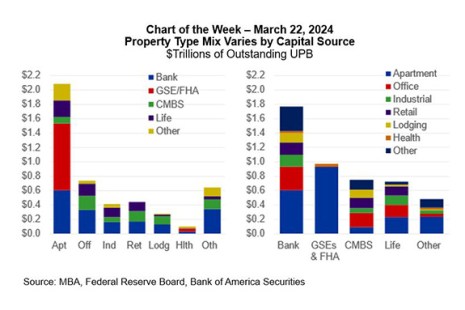

MBA Chart of the Week: CRE Mortgage Debt Across Capital Sources, Property Types

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.

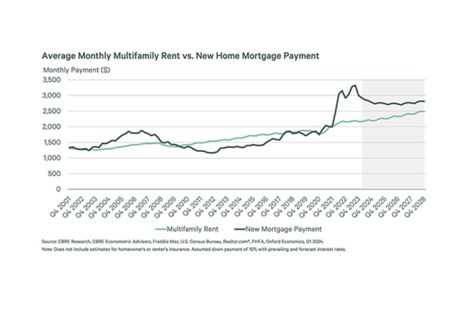

CBRE: Renting Less Expensive Than Mortgage Payments

CBRE, Dallas, released a new report finding average mortgage payments are 38% higher than average apartment rents as of year-end.

Zillow Finds Concessions Cool as Spring Rental Season Approaches

Following a winter that saw nearly a third of rental listings offering tenants tempting concessions such as free months of rent or free parking, Zillow, Seattle, said the share of rentals offering perks may have peaked.

Dealmaker: Berkadia Closes $89M in Multifamily Sales

Berkadia, New York, closed $89 million in multifamily property sales in Denver, Colo., and Urbana, Ill.

CREF Policy Update March 28: MBA’s Fratantoni Testifies Before Key House Housing Subcommittee

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CMF Quote of the Week: March 28, 2024

“The disparity between mortgage payments and rental costs presents a substantial hurdle for aspiring homeowners,”

–Matt Vance, Americas Head of Multifamily Research for CBRE.

CMF Quote of the Week: March 21, 2024

“That’s actually a moving piece of legislation and a great program that is proven to create affordable housing units in this country–rental in that case.”

–MBA President and CEO Bob Broeksmit, CMB, on the LIHTC-related bill recently passed in the House of Representatives

2024 mPact Summit April 4 in Plano, Texas: Registration Closes March 29

Join your real estate industry young professional peers for MBA mPact’s second annual Summit on Thursday, April 4.

MBA Presents Burton C. Wood Award to Christine Rhea, President/CEO of the Mortgage Investors Group

The Mortgage Bankers Association presented its annual Burton C. Wood Legislative Service Award to Christine (Chrissi) Rhea, President/CEO of the Mortgage Investors Group (MIG), at MBA’s 2024 National Advocacy Conference.