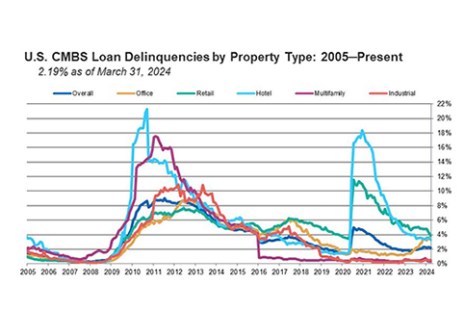

“While overall delinquencies remained flat, the delinquency rate for loans backed by office properties rose again during the first three months of this year.”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research

“While overall delinquencies remained flat, the delinquency rate for loans backed by office properties rose again during the first three months of this year.”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research

Commercial and multifamily developments and activities from MBA important to your business and our industry.

The U.S. commercial mortgage-backed securities delinquency rate decreased nine basis points to 2.19% in March, according to Fitch Ratings, New York.

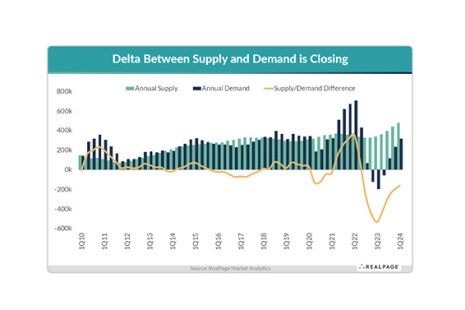

RealPage, Richardson Texas, reported that a major influx of apartment supply is continuing to temper rent and occupancy figures in the quarter.

MISMO, the real estate finance industry’s standards organization, announced that it is seeking public comment on a new Mortgage Compliance Dataset (MCD) specification.

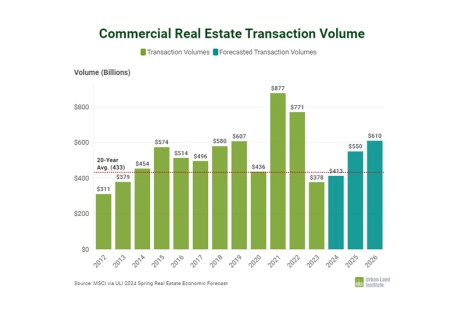

The Urban Land Institute, Washington, released its Real Estate Economic Forecast for Spring 2024. Among the major takeaways–while 2024 is seeing a solid economy, high interest rates continue to weigh on the industry.

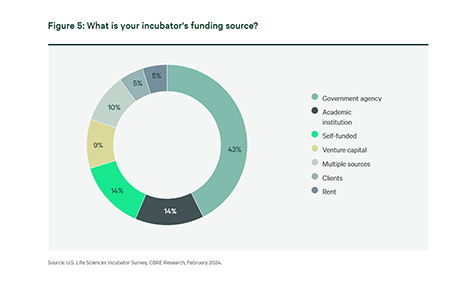

Most U.S. life sciences incubators anticipate that their funding will increase over the next five to 10 years–and 63% expect to open additional locations–according to a new survey from CBRE, Dallas.

Dwight Capital and its affiliate REIT, Dwight Mortgage Trust, announced a number of deals in March.

“Cap rates in the first quarter of 2024 represented the highest levels since 2014 for single-tenant retail properties.”

–Boulder Group President Randy Blankstein

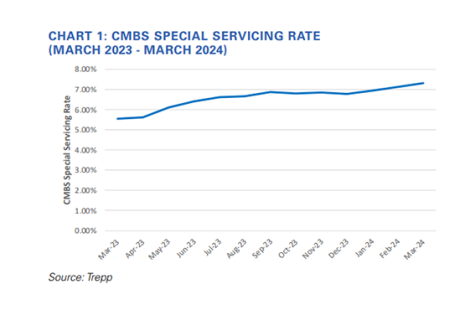

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped 17 basis points in March to 7.31%.