CommercialEdge, Santa Barbara, Calif., reported Q1 office sales fell to $5.4 billion, 17% below the 2023 first-quarter result.

Category: News and Trends

Navigating Troubled Waters: Tips and Strategies for Addressing Distressed Assets and Underperforming Loans (Sponsored Content from Selzer Gurvitch Rabin Wertheimer & Polott, P.C.)

Alonso Cisneros, an attorney with Selzer Gurvitch Rabin Wertheimer & Polott, P.C., shares ideas that lenders and borrowers can use to navigate the loan workout process in a challenging commercial real estate market.

Hotel Construction Rises for First Time in Nine Months, CoStar Finds

The volume of U.S. hotel rooms under construction grew year-over-year for the first time since last June, according to CoStar Group, Washington, D.C.

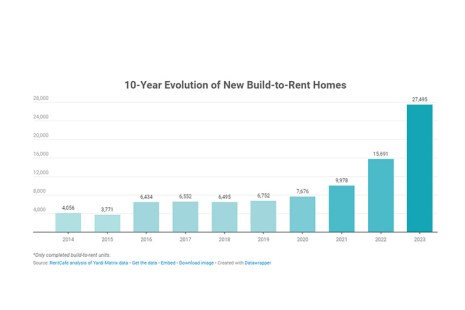

RentCafe: Build-to-Rent Housing Continues Boom

RentCafe, Santa Barbara, Calif., reported 27,500 build-to-rent homes were completed in 2023. That’s a 75% increase from 2022.

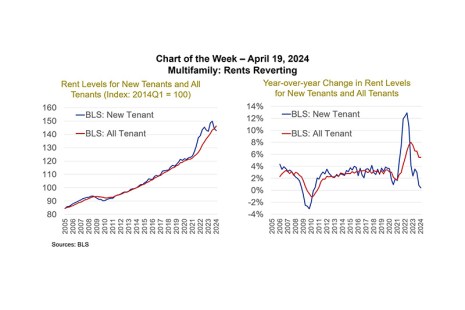

MBA Chart of the Week–Multifamily: Rents Reverting

The pandemic did a number on the housing market.

MBA Statement on HUD Updates to Wind and Named Storm Requirements

MBA’s President and CEO Bob Broeksmit, CMB, released a following regarding the Department of Housing and Urban Development’s (HUD) updates to its wind and named storm policy for Federal Housing Administration (FHA) multifamily loans.

MBA Statement on HUD’s Federal Flood Risk Management Standard Final Rule

MBA President and CEO Bob Broeksmit, CMB, released a statement regarding the Department of Housing and Urban Development’s Federal Flood Risk Management Standard final rule.

Dealmaker: Calmwater Capital Originates $12M for California Retail Property

Calmwater Capital, Los Angeles, provided Irvine, Calif.-based West Hive Capital with $12.25 million in short-term first mortgage debt for a neighborhood retail property in Rancho Palos Verdes, Calif.

Commercial and Multifamily People in the News April 25, 2024

Industry personnel news from HUD, JLL and Greystone.

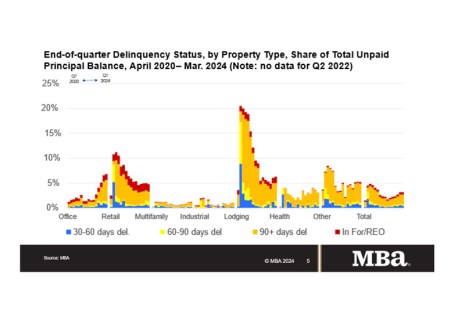

Delinquency Rates for Commercial Properties Flat in First Quarter of 2024

Delinquency rates overall for mortgages backed by commercial properties were unchanged during the first quarter of 2024, but loans backed by office properties continued to see a rise in delinquencies. This is according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance (CREF) Loan Performance Survey.