Pace Loan Group, Minneapolis, closed a $35 million C-PACE loan for a studio complex in Chesterfield, Mo., a suburb of St. Louis.

Category: News and Trends

MBA NewsLink Roundtable: The Top CMBS Issues to Watch in 2025

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives for their perspective on the industry landscape in the new year. They cover CMBS issuance, credit ratings, loan originations, loan delinquencies and loan defaults.

CMF Quote of the Week

“Monthly mortgage payments have nearly tripled over the past decade, preventing many renters from being able to buy a home.”

–Redfin Senior Economist Sheharyar Bokhari

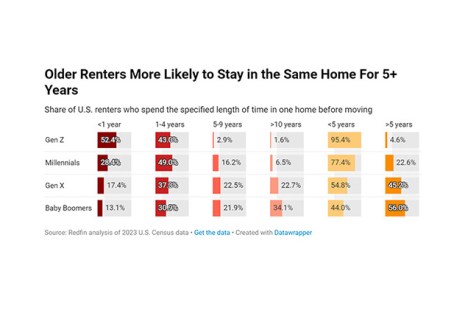

Redfin: Renters Staying in Homes Longer

Redfin, Seattle, released a new analysis finding that over a third–33.6%–of renters have lived in the same home for at least five years.

Yardi Matrix: U.S. Multifamily Enters 2025 in Good Shape

Yardi Matrix, Santa Barbara, Calif., said the multifamily market is entering 2025 in good shape, after strong demand in many markets.

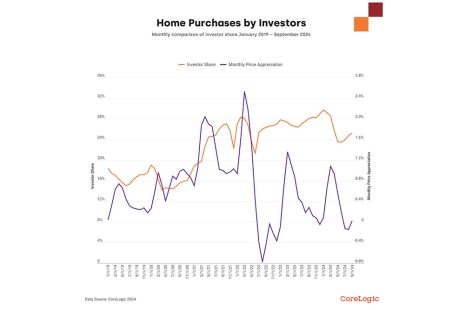

CoreLogic: Investor Share Likely to Remain Roughly Quarter of Total Sales

CoreLogic, Irvine, Calif., released its report on Q3 2024 investor activity on home purchases, finding a small uptick from mid-year numbers.

JLL Value and Risk Advisory’s Brett Suszek on 2025 Retail Trends

JLL Value and Risk Advisory’s Brett Suszek sat down with MBA NewsLink to talk trends in the retail space for 2025.

Allied Van Lines: Moves Drop In 2024, but Midsize Cities Popular

Allied Van Lines, Oakbrook Terrace, Ill., released its U.S. Migration Report, analyzing where people are moving in the U.S., and reporting that moves decreased slightly–by 7%–between 2023 and 2024.

FHFA Finalizes 2025–2027 Housing Goals for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency, Washington, D.C. issued a final rule last year establishing new affordable housing goals for the loan purchases of Fannie Mae and Freddie Mac over the next three years.

Dealmaker: M&T Realty Capital Corp. Provides Over $200M for Queens Property

M&T Realty Capital Corp., Baltimore, provided $204.95 million in financing for a multifamily property located in Long Island City in Queens, N.Y.