Commercial and multifamily developments and activities from MBA important to your business and our industry.

Category: News and Trends

Commercial People in the News, March 20, 2025

Industry personnel news from JLL, CBRE, Lument and Merchants Capital.

ULI & RCLCO: Households Face Significantly Higher Cost Burdens Than a Decade Ago

Housing cost burden is increasing across the country. In nearly every major market, households earning under $50,000 are significantly more cost-burdened than they were 10 years ago, according to the Urban Land Institute and RCLCO.

MBA Statement on the Nomination of Andrew Hughes as HUD Deputy Secretary

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on Andrew Hughes’ nomination to serve as Deputy Secretary at the Department of Housing and Urban Development (HUD).

CMF Quote of the Week

“On behalf of MBA, I congratulate Andrew Hughes on being nominated to serve as the next Deputy Secretary at HUD. His prior experience as HUD Chief of Staff for Secretary Ben Carson gives him a unique perspective on ways to improve HUD’s operations, including its programs to support affordable homeownership and rental housing opportunities.”

–MBA’s President and CEO Bob Broeksmit, CMB

Single-Family Construction Ends 2024 With Growth; Greater Uncertainty for 2025

A lack of existing home inventory boosted single-family construction growth in all geographic regions to end 2024, according to the National Association of Home Builders Home Building Geography Index for fourth-quarter 2024.

Office Building Owners Offering Fewer Concessions to Tenants, CBRE Finds

The enticements that companies receive to sign new office leases declined last year, on average, for the first time since at least 2019, according to CBRE, Dallas.

Redfin: Investor Home Purchases Drop Slightly in Q4

Redfin, Seattle, reported investor activity declined in Q4, with 47,004 homes purchased.

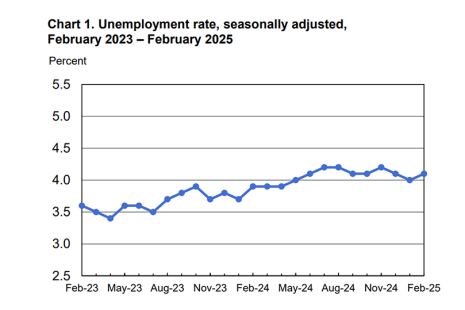

Jobs Up by 151,000 in February; Unemployment Rate Ticks Up

The Bureau of Labor Statistics released February employment numbers, finding total nonfarm payroll rose by 151,000 in February.

RentCafe: Miami, Chicago Area Top Rental Competition List

RentCafe, Santa Barbara, Calif., reported that while the hottest spot for renters is Miami, the Chicago suburbs are a close rival.