Point2Homes, Santa Barbara, Calif., released a new report finding that renters are staying in single-family homes for longer.

Category: News and Trends

CMF Quote of the Week

“State-by-state adoption of CPACE gained further momentum last year. Several new states passed C-PACE program legislation to bring the total to 40 states including Washington, D.C. And enhancements to individual programs, such as in New York City, continue to fine-tune local regulations for easier implementation.”–Anne Hill, Senior Vice President of Bayview PACE, a subsidiary of Bayview Asset Management

ATTOM: Homeownership Remains a Financial Stretch

Median-priced single-family homes and condos were less affordable in first-quarter 2025 compared to historical averages in 97% of counties around the nation with enough data to analyze, according to ATTOM, Irvine, Calif.

Trepp: CMBS Delinquency Rate Jumps in March

Trepp, New York, reported the CMBS delinquency rate rose in March, with the overall delinquency rate up 35 basis points to 6.65%.

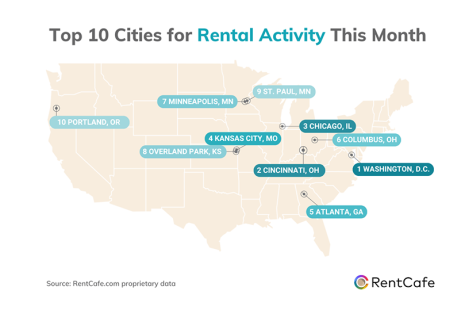

RentCafe: D.C. Still Top City for Renter Interest

RentCafe, Santa Barbara, Calif., released its rental activity report, finding that the nation’s capital once again ranked No. 1 in February.

RealPage: Some Florida Beach Town Rents Run Ahead of National Numbers

RealPage, Richardson, Texas, released an analysis on rent prices along the Florida coastline, five years after the COVID-19 pandemic sparked more remote work and mass migration.

C-PACE Financing Grows as Banks Warm Up, Regulations Improve

With a record $2.5 billion in 2024, C-PACE is mainstreaming, writes Anne Hill, Senior Vice President of Bayview PACE, a subsidiary of Bayview Asset Management.

Dealmaker: Access Point Financial Participates in $75M Mezzanine Financing

Access Point Financial, Atlanta, participated in providing $75 million in mezzanine financing for the 30-story Pendry Hotel & Residences in Nashville, Tenn.

CREF Policy Update: FHFA Withdraws Landlord-tenant Restrictions, Radon Testing Directives

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CMF Quote of the Week

“Owning a home used to be the crux of the American dream, and while many still consider it a rite of passage, a lot of people are opting to rent for longer because they can’t afford to buy a place of their own. Even people who can afford to buy homes are choosing leases over mortgages, often because they want a flexible, low-maintenance lifestyle, or want to invest their money somewhere other than real estate.”

–Redfin Chief Economist Daryl Fairweather