Looking for a place to launch–or provide a mortgage to–a startup? Oklahoma City, Kansas City and Jacksonville provide best potential for growth, while affordability and labor-competition challenges see Silicon Valley desirability fade, according to a new report from Zillow Inc., Seattle.

Category: News and Trends

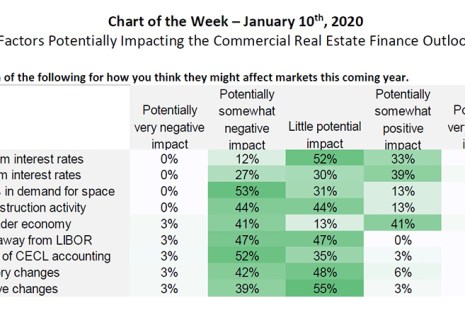

MBA Chart of the Week: Factors Impacting Commercial Real Estate Finance

Buoyed by low interest rates, strong property markets and rising property values, commercial and multifamily mortgage banking firms anticipate a solid year in 2020, according to MBA’s 2020 Commercial Real Estate Finance Outlook Survey.

CREF Outlook Survey: Majority of Firms Expect Originations to Increase in 2020

Following an anticipated record year of lending in 2019, commercial and multifamily mortgage originators expect 2020 to be another strong year in activity, according to the Mortgage Bankers Association’s 2020 Commercial Real Estate Finance Outlook Survey.

MBA Education Webinars Now Free to MBA Members

All MBA member companies in good standing now have more MBA benefits to celebrate, including complimentary access to all online education webinars and webinar recordings.

MBA Education School of Multifamily Mortgage Banking in Washington, D.C. Feb. 2020

MBA Education’s Multifamily School of Mortgage Banking provides a comprehensive and interactive look at the critical elements of multifamily real estate finance. Click here for more information or to register.

MBA CREF Forecast: 2020 Commercial/Multifamily Lending to Climb 9 Percent to $683 Billion

Commercial and multifamily mortgage bankers are expected to close a record $683 billion of loans backed by income-producing properties in 2020, a 9 percent increase from 2019’s anticipated record volume of $628 billion, according to a new Mortgage Bankers Association forecast.

Investor-Driven Lender Growth in CRE Finance

The rise of debt funds, mortgage real estate investment trusts and other players broadly referred to as “investor-driven lenders” has been at the heart of the commercial real estate finance narrative this cycle–particularly in recent years.

Walker & Dunlop’s Wiggins Sees ‘Pivot’ to Affordability

The Mortgage Bankers Association released an interview with Walker and Dunlop Senior Vice President and Chief Production Officer, FHA, Stephanie Wiggins.

Personnel News from Berkadia, Newmark Knight Frank

Berkadia added three new mortgage banking team members to its Irvine, Calif., office: Managing Director Chuck Christensen, Senior Director Vincent Punzi and Vice President of Originations Lowell Takahashi.

MBA Opens Doors Foundation Announces Alliance with Children’s Hospital of Philadelphia

The MBA Opens Doors Foundation announced a new alliance with Children’s Hospital of Philadelphia, establishing Opens Doors’ first collaboration with a Pennsylvania-based hospital.