Institutional Property Advisors, a division of Marcus & Millichap, sold South Hills Apartments, an 85-unit apartment property in West Covina, Calif. The $31.95 million sales price equates to $375,882 per unit.

Category: News and Trends

HUD Announces New CARES Act Mortgage Payment Relief Guidance

HUD announced new mortgage payment relief guidance under the CARES Act for borrowers with multifamily mortgages insured by FHA or borrowers participating in other HUD multifamily housing programs.

MBA: 2019 Commercial/Multifamily Originations Reach Record $600.6 Billion

Commercial and multifamily mortgage bankers closed a record $600.6 billion of loans in 2019, according to the Mortgage Bankers Association’s 2019 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation.

CMBS Report: More Than 2,600 U.S. CMBS Borrowers Seek Coronavirus Relief; Delinquency Reports Mixed

Fitch Ratings, New York, reported more than 2,600 commercial real estate borrowers, representing $49.1 billion of mortgage loans, have sought potential debt relief during the first two weeks of the U.S. coronavirus outbreak.

Andrew Foster, Kelly Hamill: First Aid as Paycheck Protection Program Begins

The $2 trillion CARES Act bill is designed in part to provide liquidity to small businesses—including hard hit hotels—who will turn to the program first to cover costs such as payroll, utilities and interest on debt payments. Commercial real estate borrowers, tenants and their employees are prime candidates to apply for the program and many of MBA’s member banks will be instrumental in getting this $350 billion of relief to small businesses and their employees in communities across the country through their SBA lending programs.

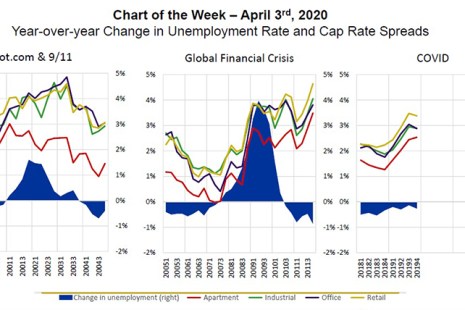

MBA Chart of the Week: Year-over-Year Change in Unemployment Rate and Cap Rate Spreads

For commercial real estate markets, a key factor in how we work through this period of uncertainty will be how investors value properties and their incomes. Our experiences in the past two recessions may provide some insights.

CREF Highlights

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

JLL, Wells Fargo Lead MBA 2019 Commercial/Multifamily Mortgage Firm Origination Volume Rankings

JLL, Wells Fargo and Eastdil Secured ranked as top commercial/multifamily mortgage originators last year, the Mortgage Bankers Association said today.

Treasury Department Creates Assistance for Small Businesses Page

The Treasury Department created an Assistance for Small Businesses page on the Small Business Administration’s loan program.

CRE Finance in an Uncertain World

MBA hosted a webinar on Friday, March 27 with commercial real estate finance industry leaders to discuss COVID-19’s impacts on the industry.