Marcus & Millichap, Calabasas, Calif., brokered the sale of a five-story, 123-room hostel in downtown San Francisco. The building sold for $19 million.

Category: News and Trends

Report Sees Potential Single-Family Rental Headaches

Single-family rental property fundamentals remain healthy, but there could be trouble on the horizon.

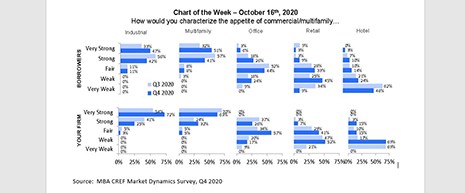

MBA Chart of the Week: Appetite for Commercial and Multifamily

One of the most striking aspects of the pandemic’s impact on commercial real estate markets is the markedly disparate impact it is having on different property types.

MBA Recognizes Select Members

MBA recognizes its Select Associate Members and thanks them for their continued support of MBA and the real estate finance industry.

MBA Recognizes Premier Members

MBA is proud to recognize its Premier Associate Members and thank them for their continued support of MBA and the real estate finance industry.

MORPAC Honors CBRE’s Jeff Hurley with 2020 Schumacher-Bolduc Award

The Mortgage Bankers Association Political Action Committee honored Jeff Hurley, Senior Managing Director with CBRE, with the 2020 Schumacher-Bolduc Award.

MBA Annual20: FHFA Proposes Rule for New Enterprise Products, Activities

Federal Housing Finance Agency Mark Calabria told MBA members that the agency wants comments on a proposed rule that would require Fannie Mae and Freddie Mac to obtain approval for new products and notice before engaging in new activity.

Brian Stoffers, CMB, Reflects on Year as MBA Chairman

Brian Stoffers, CMB, served as Chairman of the Mortgage Bankers Association during perhaps the most interesting year in its history—not that he or anyone else planned it that way.

MBA Swears in 2021 Officers: Susan Stewart, Kristy Fercho, Matt Rocco

The Mortgage Bankers Association on Monday swore in Susan Stewart as its 2021 Chair; Kristy Fercho as Chair-Elect; and Matt Rocco as Vice Chair at its virtual 2020 Annual Convention & Expo.

Personnel News From JLL, Walker & Dunlop, Realty Income

JLL Hotels & Hospitality promoted Mike Huth to Executive Vice President of Hotels Debt Capital Markets. He will help lead the firm’s hotel investment banking strategy and will oversee deal execution across the platform.