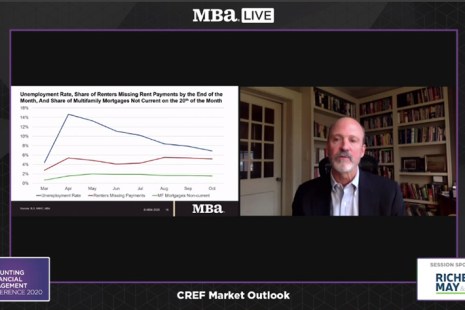

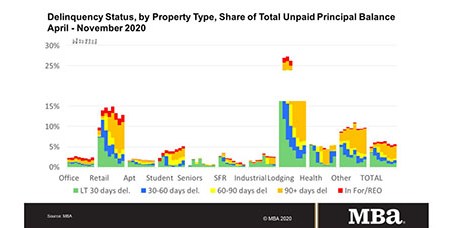

The pandemic has affected different commercial property types in very different ways, and they will likely perform differently when the economy bounces back, said MBA Vice President of Commercial Real Estate Research Jamie Woodwell.

Category: News and Trends

MBA: Commercial/Multifamily Mortgage Delinquency Rates Continue to Vary by Property Types, Capital Sources

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released today by the Mortgage Bankers Association.

Briefs from Freddie Mac, Moody’s Analytics REIS, Lument

Freddie Mac, McLean, Va., announced its latest offering of Structured Pass-Through K Certificates will include classes of floating-rate bonds indexed to the Secured Overnight Financing Rate and backed by underlying mortgages that are also indexed to SOFR.

Dealmaker: JLL Arranges $150M Fairmont San Francisco Refinance

JLL, Chicago, arranged a $150 million refinancing for the 606-key Fairmont San Francisco for borrower Mirae Asset Global Investments, Seoul, South Korea.

Hotel Sector Recovery Slows

The hotel sector recovery has slowed in recent months after rebounding in the fall from April lows, said Fitch Ratings, New York.

REIT Outlook Negative, But Improving

The 2021 rating outlook for U.S. real estate investment trusts remains negative, but Fitch Ratings, New York, said its outlook for the sector is improving.

Suburban Rental Growth Outpacing Urban

RCLCO, Bethesda, Md., noted rental housing occupancy and rents have grown stronger in suburban markets than in urban areas recently.

Personnel News from CBRE, Altus Group, RCLCO

CBRE promoted Aja Ladson to lead the Quality, Health, Safety and Environment function within the firm’s Global Workplace Solutions business.

CMBS Delinquency Rate Dips

The commercial mortgage-backed securities delinquency rate dipped in November, largely due to continued Coronavirus debt relief, said Fitch Ratings, New York.

Top Five Commercial Mortgage Servicing Issues to Watch in 2021

While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year.