The Mortgage Bankers Association’s young professional’s group, mPact, welcomes a new chair this month for the Commercial Production Advisory Council, Berkadia’s Maggie Burke.

Category: News and Trends

A ‘Resilient’ Net-Lease Retail Sector

As pandemic-related economic uncertainty loomed last year, investors looked to single-tenant net-leased properties for financial security and less volatility, said Colliers International, Toronto.

Dealmaker: Gantry Secures $26M for Office Properties

Gantry, San Francisco, secured $25.6 million in financing for two Seattle office assets.

A Conversation with MBA Affordable Housing Advisory Council Co-Chairs

The Mortgage Bankers Association recently created two Affordable Advisory Councils, dedicated to supporting CONVERGENCE, the MBA Affordable Housing Initiative. These Councils are currently led by four senior executives: Christine Chandler (M&T Realty Capital Corp.), Tony Love (Bellwether Affordable Housing Group), Anthony Weekly (Truist Bank) and David Battany (Guild Mortgage).

Office Demand Approaches Pre-COVID Levels in Some Large Market

One year after the pandemic started, demand for office space in the country’s largest markets is approaching pre-COVID levels and recovery appears to be looming for several markets, reported VTS, New York.

Personnel News from Electra Capital, M&T Realty Capital Corp.

Electra Capital, Lake Park, Fla., appointed Eugene Rutenberg to serve as Managing Director of Originations

Quote

“Commercial and multifamily mortgage delinquencies fell for the third straight month in March and are now at their lowest level since the pandemic disrupted the economy and commercial real estate a year ago. There continues to be significant differences in loan performance by property type, with higher delinquencies rates for lodging- and retail-backed mortgages.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

Personnel News from Electra, M&T Realty Capital Corp.

Electra Capital, Lake Park, Fla., appointed Eugene Rutenberg to serve as Managing Director – Originations.

Quote

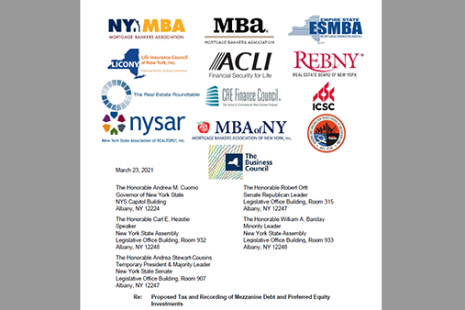

“We believe the enactment of these taxes would exacerbate the affordable housing challenges in New York and effectively increase rents on low- to middle-income New York families and small businesses, at a time when they can least bear that increase.”

–MBA-led coalition letter to New York political leaders opposing a proposed tax and recording requirement for mezzanine debt and preferred equity.

MBA Letters Oppose Proposed New York Mezzanine Debt/Preferred Equity Tax, Support Like-Kind Exchanges

The Mortgage Bankers Association weighed in to oppose a proposed New York tax and recording requirement for mezzanine debt and preferred equity and to support like-kind exchanges.