“Over the past year, pandemic-related restrictions have led to deteriorating fundamentals in particularly the hotel, retail and office sectors.” –Moody’s Managing Director Keith Banhazl.

Category: News and Trends

MBA Seeks COMBOG Committee Nominations by April 30

The Mortgage Bankers Association’s Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) Nominating Committee seeks members’ recommendations for individuals to serve on the Board beginning this October in the Investor, Lender, Mortgage Banker and Servicer categories. This is an important process that determines the leadership for MBA’s commercial/multifamily membership.

SBA Releases Restaurant Revitalization Fund Guide and Requirements–Application Process to Open Soon

The Small Business Administration launched a webpage on its Restaurant Revitalization Fund program, which provides emergency assistance for eligible restaurants, bars and other qualifying businesses affected by COVID-19.

Brace for Impact: CRE Finance Implications of Transition Away from LIBOR

The finance industry’s march towards transition away from LIBOR index continues as the third quarter approaches. For all the talk of upward revisions to economic growth projections, the market still awaits the first balance sheet commercial mortgage loan based on SOFR index.

Freddie Mac: Expanded Pandemic Benefits Helping Unemployed Renters

Expanded unemployment benefits and federal stimulus payments are benefiting unemployed renters during COVID-19, reported Freddie Mac Multifamily, McLean, Va.

Personnel News From Gantry, CBRE

Gantry, San Francisco, expanded its origination and production team with two new professionals working from its Phoenix, Ariz. and Newport Beach, Calif. offices.

CMF Briefs From Vornado, LBC Credit Partners

Vornado Realty Trust, New York, said Vornado Realty L.P., the operating partnership through which Vornado Realty Trust conducts its business, has extended one of its two unsecured revolving credit facilities to April 2026.

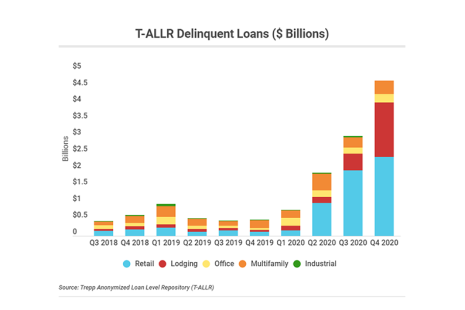

Trepp: Fourth-Quarter Bank CRE Loan Data Show ‘Elevated Distress’

The U.S. economy is well into its recovery from the pandemic recession, but Trepp LLC, New York, noted bank commercial real estate loans indicated “elevated distress” in the fourth quarter.

‘Big Money’ Activity Crops Significantly During Pandemic

Major institutional real estate owners’ investment activity fell significantly due to the pandemic, but their portfolio allocations did not deviate significantly, reported Reonomy, New York.

MBA, Coalition Support Bill to Create More Housing Near Transit

The Mortgage Bankers Association and nearly 100 industry trade and community organizations sent a letter to the House this week urging support for legislation that would promote housing development and construction near transit hubs.