Freddie Mac, McLean, Va., named Jason Griest Vice President of Multifamily Securitization.

Category: News and Trends

Sublease Space Weighing Office Market Down

Office vacancy rates have risen significantly since the pandemic hit. Yardi Matrix, Santa Barbara, Calif., reported one big reason for the spike: nearly every market has seen sublease space available jump.

JLL: Seniors Housing Sector Positioned for Growth

The seniors housing sector should grow as long-term demand remains positive and an aging Baby Boomer population needs more care, reported JLL Valuation Advisory, Chicago.

MBA Names Alden Knowlton Associate Vice President of Legislative Affairs; Rachel Kelley Associate Vice President of Political Affairs

The Mortgage Bankers Association named Alden Knowlton Associate Vice President of Legislative Affairs and hired Rachel Kelley as Associate Vice President of Political Affairs.

MBA Nominates Mark Jones of Amerifirst Home Mortgage as 2022 MBA Vice Chairman

The Mortgage Bankers Association nominated Mark Jones, CEO and Co-Founder of Amerifirst Home Mortgage, Kalamazoo, Mich. to serve as its Vice Chairman for the 2022 membership year. He is expected to be installed at the association’s 108th Annual Convention & Expo this October in San Diego.

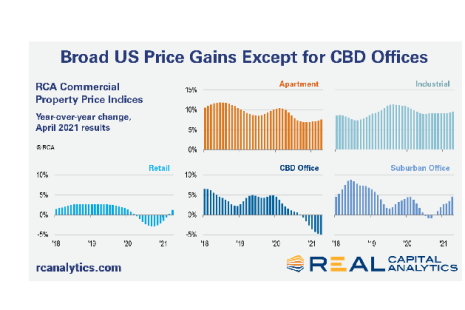

CRE Price Growth Starts Second Quarter Strong

U.S. commercial property prices started the second quarter with healthy growth.

Longtime CRE Leader Stacey Berger Retires

Stacey Berger, Executive Vice President and longtime Co-Head of Midland, Overland Park, Kan., recently announced his retirement effective May 31.

Commercial/Multifamily Briefs: Eastern Union, CREtelligent, REIT Earnings

Eastern Union, New York, is offering paid internships in data analytics and research, one of the most in-demand skills in today’s business marketplace.

Quote

“Mark [Jones] is a fierce advocate for mortgage lenders and their customers, and I am pleased to welcome him to MBA’s leadership ladder. He is an industry trailblazer and a valuable voice for sustainable, affordable housing and communities across the country, making him a terrific fit to lead MBA and its members.”–Susan Stewart, MBA 2021 Chair and CEO of SWBC Mortgage, San Antonio, Texas.

CREF Policy Update June 3, 2021

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.