CBRE Group, Dallas, acquired Union Gaming, an investment bank and advisory firm focused on the global gaming sector.

Category: News and Trends

MISMO Seeks Participants for Phase Two of Commercial Appraisal Dataset Standard Focusing on Retail, Office, Industrial Properties

MISMO®, the real estate finance industry’s standards organization, seeks participants for its Commercial Appraisal Development Work Group (DWG) as Phase 2 kicks off with a focus on expanding the Commercial Appraisal Dataset Standard to include more data points related to retail, industrial and office (RIO) properties.

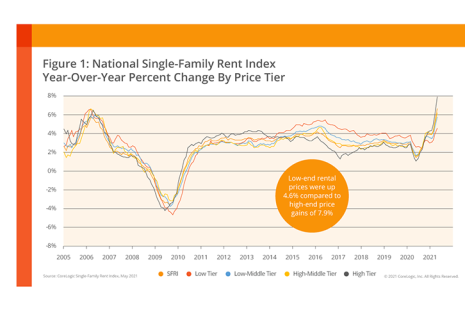

Domino Effect: Single-Family Rent Growth Rate Spikes in May as Housing Economy Challenges Persist

CoreLogic, Irvine, Calif., said single-family rent growth reached 6.6% year-over-year in May, up from a 1.7% year-over-year increase in January 2020.

Personnel News From JLL, Bellwether Enterprise

JLL Valuation Advisory expanded its new Environmental and Property Condition team with three hires: George Bouchie, Ken Voyles and Lisa Dorn.

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

MBA DEI Leadership Commercial/Multifamily Award: Nomination Deadline Aug. 13

Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards.

Quote

“Many factors already are in place to fuel strong tech talent job growth this year and beyond coming out of the pandemic. Big tech markets will gain from their established pipelines of tech graduates and many workers’ return to city centers. Smaller markets will reap benefits from their cost advantages in labor and real estate as well as the tech industry’s embrace of remote work for certain employees.”

–Todd Husak, Managing Director of CBRE’s Tech & Media Practice Group.

Industrial Sector Demand, Deliveries Reach New Records

The industrial sector saw record-setting demand and deliveries in first-half 2021, reported Cushman & Wakefield, Chicago.

Dealmaker: Mesa West Capital Provides $188M to Finance Three Multifamily Transactions

Mesa West Capital, Los Angeles, funded $187.5 million in first mortgage debt secured by apartment communities in Chicago, Phoenix and Portland, Ore.

New Alliance Seeks ‘Roadmap to Equity’ in Commercial Real Estate

The commercial real estate industry lacks diversity, and industry leaders agree that transformation is imperative.