August set records for U.S. apartment rent growth and occupancy, reported RealPage, Richardson, Texas.

Category: News and Trends

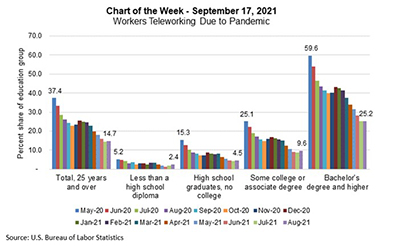

MBA Chart of the Week: Teleworking Due to Pandemic

The COVID-19 pandemic has forced many businesses to change the way they operate, and even 18 months later, there are different views and strategies for the workplace, with teleworking at the center of many discussions.

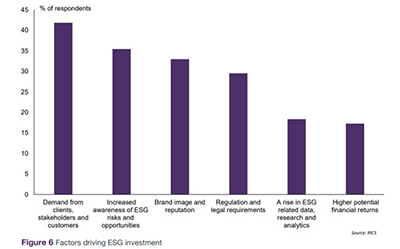

RICS: Owners Must Accelerate Decarbonization Effort to Support Net-Zero Goal

Commercial property owners are moving in the right direction but must move faster to decarbonize buildings, according to the Royal Institute of Chartered Surveyors and World Built Environment Forum.

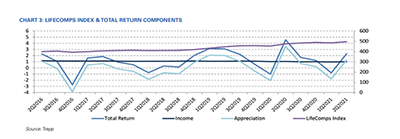

Life Insurance Commercial Mortgage Returns Bounce Back

Trepp LLC, New York, said commercial mortgage investments held by life insurance companies bounced back in the second quarter after turning negative in early 2021.

MBA CONVERGENCE Environmental Scan Examines Affordable Rental Housing Challenges, Opportunities

MBA CONVERGENCE, the national strategy by the Mortgage Bankers Association to bring together lenders, community leaders and public officials for new solutions to America’s affordable housing challenges, released an Environmental Scan examining affordability challenges in rental housing markets.

Dealmaker: Gantry Secures $190M for Seattle Mixed-Use Asset

Gantry, San Francisco, arranged a $190 million loan to recapitalize the Carillon Point mixed-use campus in Kirkland, Wash.

Commercial Property Appreciation Accelerates for 5th Straight Month

Commercial property prices just keep increasing, according to reports from CoStar, Washington, D.C. and Green Street, Newport Beach, Calif.

CREF Policy Update Sept. 23, 2021

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Commercial/Multifamily Briefs from Green Street, Freddie Mac

Green Street, Newport Beach, Calif., added U.S. Sales Comps to its web-based intelligence and analytics platform. Green Street’s U.S. Sales Comps provides accurate and comprehensive coverage of transactions valued at $5 million and up, plus proprietary macro, sector and market analytics.

Quote

“Single-family rent prices continue to climb as national economic recovery, the overcrowded purchase market and deficient inventory puts pressure on the rental market. With eviction moratoriums coming to a close this fall, and single-family rental inflation showing no signs of slowing over the next several months, affordability challenges may begin over the next several months, affordability challenges may begin to pose a more urgent concern for renters.”

–Molly Boesel, Principal Economist with CoreLogic, Irvine, Calif.