The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

Category: News and Trends

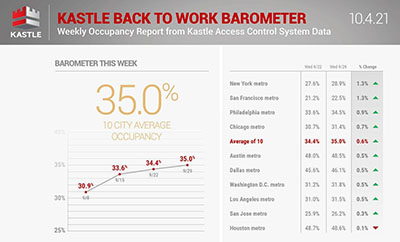

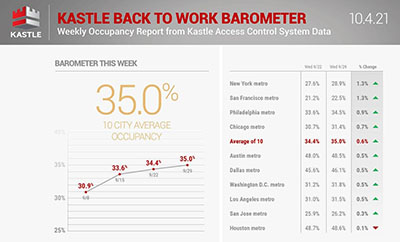

Office Demand Increases, But Full Return Remains Far Off

New demand for office space rose in August, indicating the Delta variant did little to damp employers’ searches.

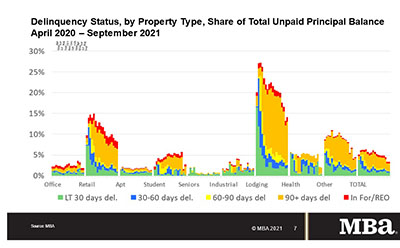

MBA: September Commercial, Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

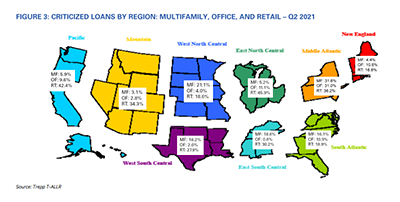

Trepp: Bank Commercial Real Estate Loan Performance ‘Not Bad, But Maybe Not That Great’

Trepp, New York, said delinquency rates for commercial real estate loans held by banks are declining after increasing modestly last year.

Dealmaker: Mesa West Capital Provides $77M for Florida Apartment Community

Mesa West Capital, Los Angeles, provided $77 million in first mortgage debt for Alta Congress, a 369-unit multifamily property in Delray Beach in Palm Beach County, Fla.

Apartment Demand Soars

Demand for apartments continues to soar. RealPage, Richardson, Texas, reported the nation’s occupied apartment count jumped by more than a quarter-million units during the third quarter.

Net Lease Sector Cap Rates Reach New Lows

The Boulder Group, Wilmette, Ill., said single-tenant net lease cap rates fell to new lows for all three asset classes in the third quarter.

Student Housing Trends: A Q&A with JLL

MBA NewsLink interviewed JLL Capital Markets Senior Director Teddy Leatherman and JLL Valuation Advisory Senior Vice President Kai Pan about the current state of the student housing market and what might be in store for the sector.

Office Demand Increases, But Full Return Remains Far Off

New demand for office space rose in August, indicating the Delta variant did little to damp employers’ searches.

Personnel News From M&T Realty Capital Corp., Bellwether Enterprise

M&T Realty Capital Corp., Baltimore, appointed Donna Falzarano as a Managing Director in its Florham Park, N.J. office.