The Association of Foreign Investment in Real Estate, Washington, D.C., said international real estate investors feel cautiously enthusiastic about U.S. commercial real estate.

Category: News and Trends

MBA Announces Commercial Real Estate/Multifamily Finance Board of Governors for 2022

SAN DIEGO–The Mortgage Bankers Association announced the members of its Commercial Real Estate/Multifamily Finance Board of Governors for 2022.

JLL Construction Outlook: Material, Labor Availability Constrain Recovery

JLL, Chicago, said the construction industry has weathered the past 18 months well by most measures, but challenges remain.

MBA Launches Member Action Pledge to Promote Minority Homeownership, Affordable Rental Housing DEI

SAN DIEGO—Mortgage Bankers Association Chairman Kristy Fercho on Monday announced the Home for All Pledge, an MBA member company action pledge to promote minority homeownership, affordable rental housing and company diversity, equity and inclusion.

Quote

“This year’s COMBOG lineup represents a comprehensive collection of industry experts who know what’s best for the entire real estate finance industry.” –Kristy Fercho, MBA Chairman and Executive Vice President and Head of Home Lending at Wells Fargo.

Personnel News From JLL, Eastern Union

JLL Hotels & Hospitality Senior Managing Director Kevin Davis was named to Cornell’s Center for Real Estate and Finance advisory board.

MBA Elects 2022 Officers: Kristy Fercho, Matt Rocco, Mark Jones

SAN DIEGO—The Mortgage Bankers Association swore in Kristy Fercho, Executive Vice President and Head of Home Lending with Wells Fargo, as MBA 2022 Chairman on Sunday during the association’s 2021 Annual Convention & Expo.

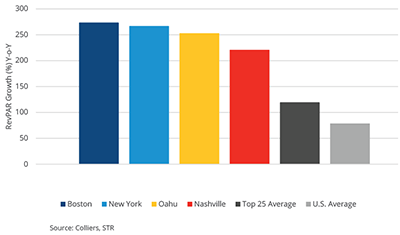

Hotel Sector ‘In a Far Different Place’

No property type’s fundamentals have rebounded as swiftly as the hotel sector’s, reported Colliers, Toronto.

Dealmaker: Walker & Dunlop Completes $80M in Multifamily Property Sales

Walker & Dunlop, Bethesda, Md., closed $79.7 million in multifamily property sales in Colorado and New Jersey.

Emerging Trends Report Finds Positive Commercial Real Estate Environment

Significant capital, low interest rates and continued demand for many product types are creating a positive commercial real estate environment, PwC and The Urban Land Institute said in their Emerging Trends in Real Estate report.