Rabbet, Austin, Texas, released its annual 2021 Construction Payments Report, which found general contractors and subcontractors estimate that the cost of floating payments for wages and invoices represents $136 billion in excess cost to the industry, a 36 percent increase from the cost reported in 2020.

Category: News and Trends

MBA Announces 2022 Affordable Rental Housing Advisory Council

The Mortgage Bankers Association announced members of its 2022 Affordable Rental Housing Advisory Council. The Advisory Councils on affordable rental housing and affordable homeownership were formed in 2019 to provide important strategic and practical guidance to MBA’s CONVERGENCE Initiative, the association’s affordable housing effort.

KBRA: Pandemic Shutdown Bifurcates Commercial Real Estate Market

Pandemic-related shutdowns and restrictions bifurcated the commercial real estate market based on its demand generators, reported Kroll Bond Rating Agency, New York.

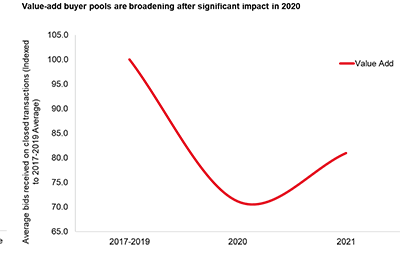

JLL: Value-Add Office Back in Favor

Many office investors focused on core office properties during the pandemic, but value-add liquidity is quickly recovering as clarity surrounding rent growth and the future of office demand improve, said JLL, Chicago.

MBA Promotes Bruce Oliver, Laura Hopkins

The Mortgage Bankers Association promoted Bruce Oliver to Vice President of Commercial and Multifamily Policy and Laura Hopkins to Vice President of Member Relations.

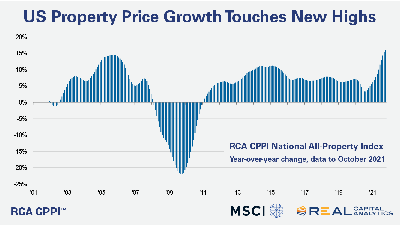

Commercial Property Price Growth Breaks Records as Demand Swells

Real Capital Analytics, New York, reported most commercial real estate types posted double-digit annual price growth in October.

Personnel News From JLL, Marcus & Millichap, NewPoint

JLL Valuation Advisory hired Dennis Firestone to join its Environmental and Property Condition team as a Senior Vice President for EPC Premier Client Accounts.

CREF Policy Update Dec. 9, 2021

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Quote

In addition to the continued strength of the housing market, we also believe the commercial mortgage-backed securities market should see more activity in 2022.

–David Harrison, Chief Operating Officer with Midland Loan Services.

Welcome News for the Retail Sector

The retail sector’s solid performance in recent quarters has been a welcome surprise, said Moody’s Analytics, New York.