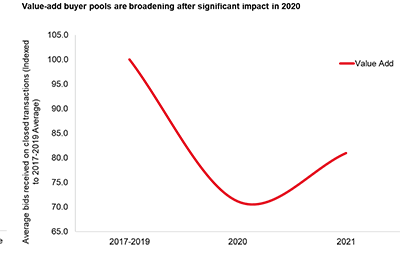

“None of us have lived through a pandemic before, so forecasting the ‘after’ is not only hard, but probably pretty risky. Nevertheless, we absolutely lucked out in pretty much every asset class, except for retail, and even in that, the bounce back is significant.”

–Shekar Narasimhan, CMB.