Fitch Ratings, New York, reported 17 percent of U.S. equity real estate investment trusts had negative outlooks in December, down significantly from a year ago.

Category: News and Trends

Office Space Recovery Pauses

Office leasing activity slowed in December, reported CBRE, Dallas.

ULI: Infrastructure Investment Can Yield More Equitable, Sustainable Communities

Real estate developers and policymakers can promote equity, environmental resilience and economic mobility by investing in forward-looking infrastructure, said the Urban Land Institute, Washington, D.C

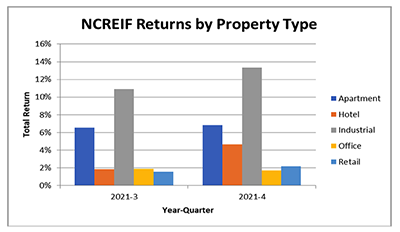

Institutional-Quality Real Estate Returns Set Record

Institutional-quality commercial real estate returned 6.15 percent in the fourth quarter, up from 5.23 percent in the third quarter, the National Council of Real Estate Investment Fiduciaries reported.

Fed Sets Stage for March Rate Hike

The Federal Open Market Committee did not pull trigger on an increase to the federal funds rate last week—but it left little doubt about action at its next policy meeting in March.

MISMO Launches Updated Commercial Green Utility Dataset

MISMO®, the real estate finance industry standards organization, announced availability of its updated Commercial Green Utility Dataset standard. The dataset and accompanying package of resources help facilitate the efficient exchange of Green Utility information across the commercial real estate finance industry.

Quote

“Many of us are competitors; very, very strong competitors. But when we get in the room, we’re friends. We exchange ideas and challenges that we all face. MBA brings us together.”

–CBRE Capital Markets Executive Managing Director Jeff Majewski.

Commercial, Multifamily Briefs from Chatham Financial, CBRE and Project Destined

Chatham Financial, Kennett Square, Pa., will host its Semiannual Market Update for Real Estate on Wednesday, Feb. 9 at 11:00 AM ET.

CREF Policy Update Feb. 3, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

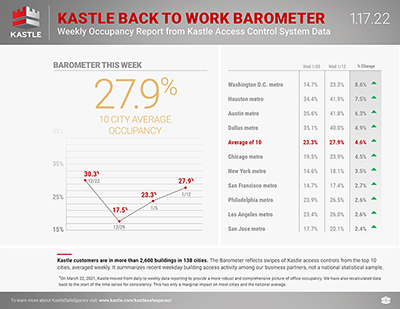

Employers Pause Return-to-Office Plans

Employers are pausing their return to office plans in light of the Delta and Omicron COVID variants, said Yardi CommercialEdge, Santa Barbara, Calif.