Commercial mortgage-backed securities defeasance volume soared during late 2021 and into January, but that trend could be ending, said Fitch Ratings, New York.

Category: News and Trends

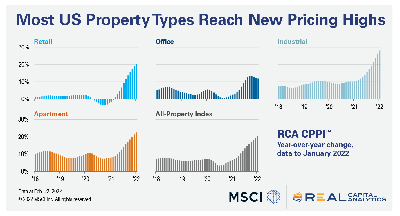

Commercial Property Prices Reach New Highs

Real Capital Analytics, New York, reported U.S. commercial property price growth continued to appreciate at a double-digit pace in January.

CREF Policy Update March 10, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Personnel News from Northmarq, JLL, Berkadia

Northmarq, Minneapolis, promoted Jeff Erxleben to President of the company’s debt & equity business.

Quote

“As dry powder earmarked for commercial real estate investment continues to grow, there is a growing sense of urgency among large investors to deploy capital efficiently. It appears the strong appetite for large portfolio deals is here to stay.”

–Sheheryar Hafeez, JLL Managing Director of M&A and Corporate Advisory Group.

Construction Posts 6th Straight Monthly Gain

Monthly construction spending started the year strongly, increasing for the sixth consecutive month, the Census Bureau reported Tuesday.

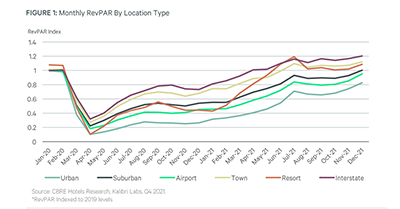

Hotel Recovery Likely to Continue

The hotel sector’s recovery that started last year will likely continue despite current operational hurdles, sector analysts said.

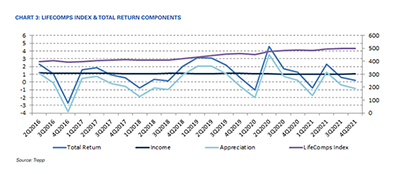

Trepp: Offices Hit 4Q Life Insurance Mortgage Returns Hard

Trepp LLC, New York, said life insurance company commercial mortgage investments saw lower returns in the fourth quarter, largely due to the hard-hit office sector.

Dealmaker: Grandbridge Closes $75M for Multifamily, Senior Housing

Grandbridge Real Estate Capital, Charlotte, N.C., closed $75.4 million in loans for multifamily and senior housing properties.

CRE Execs Optimistic Despite Growing Concerns

Commercial real estate executives remain optimistic despite growing worries about the near future, reported law firm Seyfarth Shaw LLP, Chicago.