Freddie Mac, McLean, Va., said multifamily market investment conditions turned negative in late 2021 as price appreciation and rising mortgage rates more than offset net operating income growth.

Category: News and Trends

Evolving Office Sector Could Drive Flight to Quality

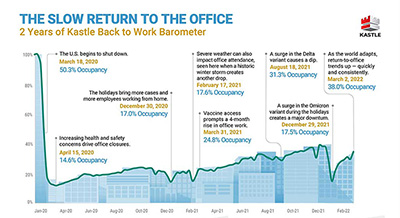

Workers are slowly returning to the office as the pandemic wanes, but office buildings remain relatively empty, reported Yardi CommercialEdge, Santa Barbara, Calif.

Data Center Market Shatters Leasing Records

North American data center leasing reached record levels last year, driven by demand from large cloud service providers and social media companies, reported CBRE, Dallas.

Commercial Real Estate Sees Double-Digit February Price Growth

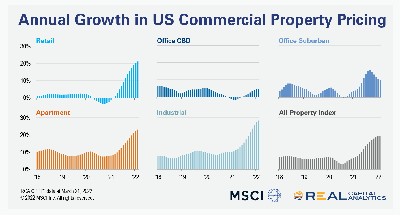

Commercial property price growth continued in February as all four major property types posted double-digit annual price growth, reported Real Capital Analytics, New York.

CREF Policy Update March 31, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Commercial and Multifamily Briefs March 31, 2022

Cushman & Wakefield acquired Grant Street Associates Inc. in Pittsburgh, Pa., after an 18-year alliance.

Quote

“It’s been a remarkable run for commercial property, but with interest rates higher, equity markets lower and now the strains of warfare in Ukraine, investors should expect price increases to slow. Because things were so hot before and real estate was so cheap versus the bond markets, bidders may push pricing a little more, but for the most part, investors should expect real estate values to stabilize.”

–Peter Rothemund, Co-Head of Strategic Research with Green Street, Newport Beach, Calif.

Reports Say Commercial Real Estate Well-Positioned to Withstand Ukraine Crisis

The crisis in Ukraine has shaken global markets but is unlikely to directly affect U.S. commercial real estate and financial firms, two reports said.

MBA: CMF Mortgage Debt Outstanding Reaches New High

Commercial/multifamily mortgage debt outstanding at year-end 2021 rose by $287 billion (7.4 percent) from the previous year, the Mortgage Bankers Association reported Wednesday.

CRE Executives See Increasing Uncertainty

After a challenging two years, the real estate industry again faces more uncertainty–and not just for the short term, a new report from the Urban Land Institute and PwC said.