Commercial and multifamily mortgage bankers closed $683.2 billion of loans in 2021, the Mortgage Bankers Association reported Thursday. MBA estimated total CRE lending including activity from smaller and mid-sized depositories totaled $890.6 billion.

Category: News and Trends

CMBS Delinquency Rate Maintains Downward Trajectory

The commercial mortgage-backed securities delinquency rate fell 10 basis points during March to 2.38 percent, driven by robust new issuance and few new delinquencies, reported Fitch Ratings, New York.

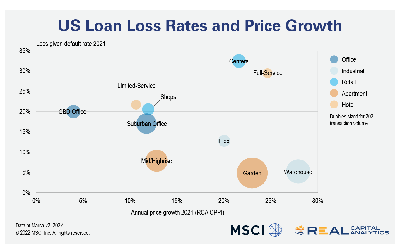

RCA: Pandemic Loan Loss Rates Below Great Recession Extremes

Real Capital Analytics, New York, said the losses taken by lenders on previously defaulted commercial real estate loans remain far below the loss rates seen during the Great Recession.

Eli Moghavem of Base Equities: Small-Balance Preferred Equity Helps Sponsors Compete for Middle-Market Opportunities

In this article, we explore preferred equity investments serving small-to-mid transaction sizes, where there can be a win-win-win for sponsors, investors and the capital markets brokerage community.

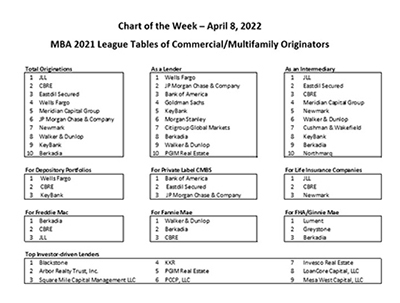

MBA Chart of the Week: Top Commercial/Multifamily Originators

MBA’s Commercial Real Estate/Multifamily Finance Firms – Annual Origination Volumes annual report presents a comprehensive set of listings of commercial/multifamily mortgage originators, their volumes and the different roles they play. The report presents origination volumes in more than 140 categories, including by role, by investor group, by property type, by financing structure type and by location of the originating office.

Commercial Construction Costs Continue to Escalate

Commercial real estate construction costs continue to increase, reported Rider Levett Bucknall, Honolulu.

Dealmaker: Berkadia Secures $132M for Multifamily

Berkadia, New York, secured $131.7 million for multifamily properties in Nebraska and Colorado.

Digitalization, Demographics, Deglobalization Redefine Industrial Real Estate

Digitalization, demographics and deglobalization will drive the industrial market growth in the near future, said Newmark, New York.

CONVERGENCE Memphis Launches New Nonprofit Organization

The Mortgage Bankers Association announced CONVERGENCE Memphis launched CONVERGENCE Memphis Inc., a 501(c)(3) organization created to strengthen ties within the local Memphis community and advance its mission of promoting affordable housing and increasing Black homeownership.

Personnel News From JLL, NorthMarq, Eastern Union

JLL Valuation Advisory hired Katie Parsons as Managing Director – Head of Industrial Property Sector, where she will focus on driving growth, building the industrial platform, enhancing the customer experience and providing value to clients.