Commercial and multifamily Briefs from Blackstone Real Estate, PS Business Parks and Goldman Sachs Asset Management.

Category: News and Trends

CREF Policy Update April 28, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Quote

“There remain many property types–including multifamily, industrial, bio-medical and others–that are seeing some of the strongest fundamentals in recent memory. That combined with healthy appetites from investors and lenders should buoy the markets this year and next.”

–MBA Vice President of Commercial Real Estate Research Jamie Woodwell .

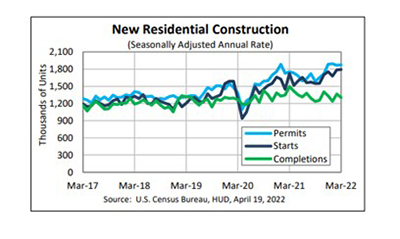

Multifamily Gives Positive Edge to March Housing Starts

Housing starts improved slightly in March, thanks to a bump in multifamily starts, HUD and the Census Bureau reported Tuesday.

MISMO Seeks Public Comment on Commercial Green Borrower Questionnaire

MISMO®, the real estate finance industry standards organization, seeks public comment on a standardized questionnaire for borrowers to answer when applying for a commercial mortgage loan.

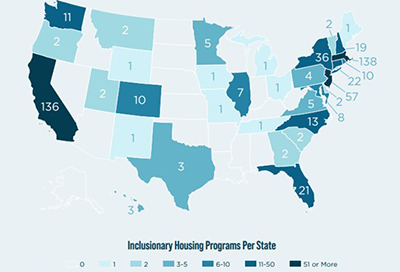

Study: Inclusionary Housing Policies Deliver More Affordable Homes

A study by a Mortgage Bankers Association-supported member network suggests an optimal mix of incentives and requirements could help policymakers avoid polarizing private sector and community stakeholder groups while working toward the goal of increasing affordable housing production.

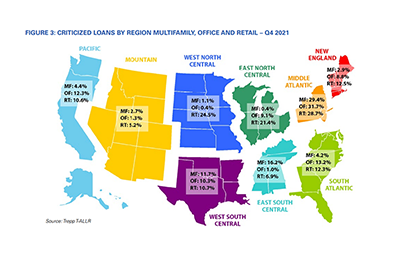

Trepp: Bank CRE Originations Up in Late 2021

Trepp, New York, reported bank commercial real estate originations rebounded in late 2021 while delinquencies continued to trend down after a moderate rise in 2020.

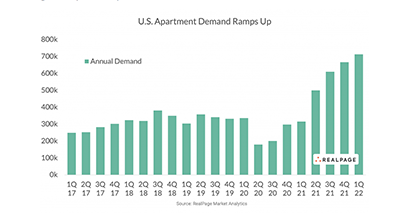

Apartment Demand, Rent Growth Reach New Highs

The apartment market reached record highs for demand, occupancy and rent growth in the first quarter–toppling previous multi-decade peaks set last year, reported RealPage, Richardson, Texas.

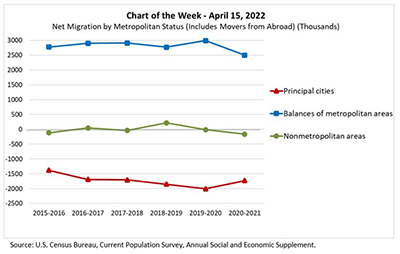

MBA Chart of the Week: Net Migration by Metropolitan Status

The Current Population Survey, sponsored jointly by the U.S. Census Bureau and the U.S. Bureau of Labor Statistics, includes an Annual Social and Economic Supplement conducted every March. The ASEC provides details on geographic mobility and migration over the last year—including information on the types of moves and the characteristics of the movers.

MBA Forecast: Commercial/Multifamily Lending Holds Steady Amid Higher Rates, Economic Uncertainty

Total commercial and multifamily mortgage borrowing and lending is expected to hold steady at a projected $895 billion in 2022, roughly in line with 2021 totals ($891 billion), the Mortgage Bankers Association said Monday.