Investments in renewable energy could unlock billions in real estate value, help building owners reduce long-term energy costs and generate supplemental income, said the Urban Land Institute, Washington, D.C.

Category: News and Trends

CMF Briefs from EQT Exeter, Redwood Capital Group, Fannie Mae

EQT AB, Stockholm, Sweden, agreed to acquire Redwood Capital Group, Chicago, a residential core plus and value-add investment manager.

U.S. Hotel Profitability Reaches 28-Month High

STR, Hendersonville, Tenn., said March U.S. hotel gross operating profits reached their highest levels since 2019.

Dealmaker: MetroGroup Secures $19M for San Diego Retail Center

MetroGroup Realty Finance, Newport Beach, Calif., arranged $18.5 million in financing for an unanchored retail center totaling 56,175 square feet in northern San Diego.

The Office of the Future, Revisited: 3 New Realities Shape Hybrid Workplace

Cushman & Wakefield issued a follow-up to its Office of the Future report last year, identifying three trends shaping workplace strategies. There’s good news and interesting news.

MISMO Seeks Public Comment on Phase Two of Commercial Appraisal Dataset

MISMO®, the real estate finance industry standards organization, seeks public comment on phase two of proposed data standards for the Commercial Appraisal Dataset. The 60-day comment period runs through July 12.

#MBACREFST22: Servicers Survive A Crisis for the Ages

LOS ANGELES–Commercial mortgage servicers have faced–and weathered–a “crisis for the ages,” said Mortgage Bankers Association Chair-Elect Matt Rocco here Monday at the MBA Commercial/Multifamily Finance Servicing and Technology Conference.

Commercial/Multifamily People in the News May 19 2022

Personnel news from NewPoint Real Estate Capital, Eastern Union.

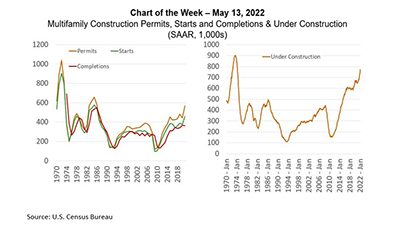

MBA Chart of the Week: Multifamily Construction

Housing markets are tight. Multifamily developers are responding.

CREF Policy Update May 19 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.