Commercial and Multifamily Briefs from TIAA Bank, Brook Farm Group

Category: News and Trends

Quote

“A fear has been that LIHTC properties would simply jack up rents to the top of the market at the expiration of their rent and income restrictions, generally about 30 years, but that’s not usually the case.”

–Steve Guggenmos, Vice President of Research & Modeling with Freddie Mac, McLean, Va.

Personnel News From MTRCC, Cushman & Wakefield, Berkadia

Christine Chandler, Chief Credit Officer and Chief Operating Officer with M&T Realty Capital Corp., Baltimore, was named a 2022 Woman of Influence by GlobeSt.com.

CREF Policy Update: July 21, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

JLL: Real Estate Transparency Gap Widens in Favor of Leading Global Markets

JLL, Chicago, said while many of the world’s leading commercial real estate markets in North America, Western Europe and Australasia are becoming more transparent, most other countries struggle to maintain the pace of transparency improvement.

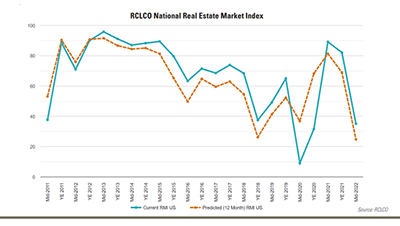

Commercial Real Estate Sentiment Dips Toward Recession Zone

Commercial real estate executives’ market sentiment has dropped dramatically, reported RCLCO, Washington, D.C.

Jeff Coles of Berkadia on Single-Family Rental/Build-for-Rent Markets

Jeff Coles is Vice President of Institutional Client Services with Berkadia, Washington, D.C. He partners with Dori Nolan, Senior Vice President of Client Services, to grow Berkadia’s relationships with current and new institutional investor clients.

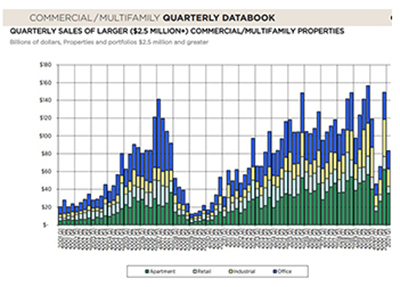

MBA Releases Q1 2022 Commercial/Multifamily DataBook

The Mortgage Bankers Association released its first quarter Commercial/Multifamily DataBook.

Personnel News from Cushman & Wakefield, Berkadia

Cushman & Wakefield hired Mia Mends as the new Chief Executive of C&W Services.

Dealmaker: Gantry Secures $35M to Refinance Seattle-Area Office Building

Gantry, San Francisco, secured $35.4 million to refinance a five-story, 200,000-square-foot single-tenant office building at 1601 Lind Ave SW in Seattle suburb Renton, Wash.