In this mPower Moments, Marcia M. Davies sits down with Christine Chandler, Chief Credit Officer and COO at M&T Realty Capital Corporation.

Category: News and Trends

Quote

“MBA commends the Biden administration for its commitment to addressing the ongoing shortage of available housing and appreciates the Treasury Department’s guidance that provides flexibility for how state and local governments can use available funds to finance affordable housing.”

–MBA President and CEO Robert Broeksmit, CMB.

CREF Policy Update: July 21, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

JLL Notes Hospitality Market ‘Disconnect’

JLL, Chicago, noted a “disconnect” between hospitality fundamentals, which it called exceptionally strong for many assets, and debt markets, which have been deteriorating meaningfully.

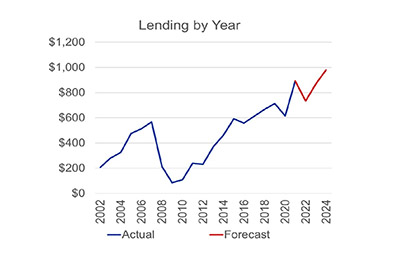

MBA Forecast: Higher Rates, Economic Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending could fall to $733 billion this year, down 18 percent from 2021 totals, according to an updated baseline forecast from the Mortgage Bankers Association.

‘Murky’ Office Sector Outlook

CommercialEdge, Santa Barbara, Calif., called the office sector’s future “murky,” even now, well over two years since the COVID-19 pandemic started.

MBA Forecast: Higher Rates, Economic Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending could fall to $733 billion this year, down 18 percent from 2021 totals, according to an updated baseline forecast from the Mortgage Bankers Association.

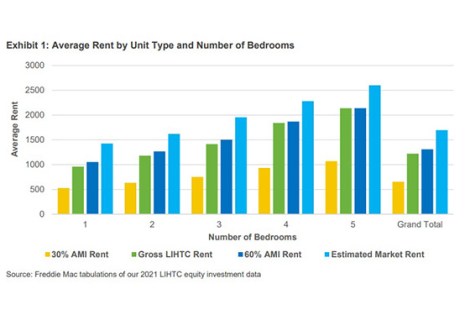

Former LIHTC Properties Remain Affordable, Freddie Mac Says

Multifamily properties that exit the Low-Income Housing Tax Credit program generally continue to rent at levels lower than those charged in the broader market, reported Freddie Mac Multifamily, McLean, Va.

CBRE: Tight Labor Market, Remote Work Changing Growth Patterns

The U.S. added 136,000 new high-tech jobs last year in hubs including the Bay Area, New York and Seattle as well as Nashville, Cleveland and other smaller markets, reported CBRE, Dallas.

Dealmaker: CBRE Sells Upper West Side Apartment for $415M

CBRE, Dallas, arranged the $415 million sale of 160 Riverside Boulevard on Manhattan’s Upper West Side to New York-based apartment investor A&E Real Estate.