Walker & Dunlop’s New York Capital Markets team closed $1.1 billion in capital markets activity in New York.

Category: News and Trends

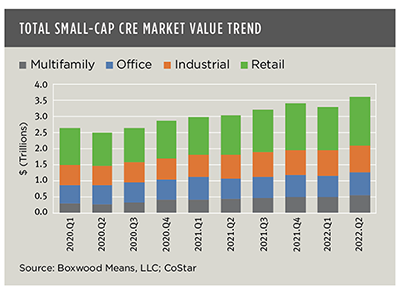

Small-Cap Commercial Real Estate Market Up 19% YoY

Boxwood Means LLC, Stamford, Conn., reported the aggregate market value of small commercial real estate assets rose steadily at midyear despite an increasingly uncertain outlook for commercial real estate prices and the economy.

MBA CONVERGENCE Webinar Aug. 25: What Does It Cost to Produce a Unit of Housing?

MBA CONVERGENCE presents the next in its webinar series, What Does it Cost to Produce a Unit of Housing? Costs & Elements of Production, on Thursday, Aug. 25 from 2:00-3:00 p.m. ET.

Quote

“Broadly speaking, the construction industry is finally returning to pre-pandemic levels of activity but is still being hampered by three familiar challenges–labor shortages, material costs and availability, and supply chain issues.”

–Roger Gingerich, Partner with Marcum.

MBA CREF Policy Update Aug. 18 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Ginnie Mae Outlines Plan to Fight Housing Costs, Boost Housing Supply

Ginnie Mae on Wednesday said it will take on a larger role in HUD’s efforts to fight rising housing costs and boost housing supply, releasing a Fact Sheet outlining its efforts to drive liquidity toward equitable and affordable housing.

MBA Letter to Agencies Targets Topline CRA Issues

The Mortgage Bankers Association last week sent a letter to federal regulatory agencies, discussing several topline issues it says are crucial to improving the current Community Reinvestment Act framework.

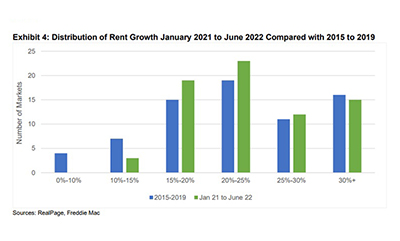

Multifamily Sector Fundamentals Could Moderate

After six months of healthy growth in multifamily fundamentals, Freddie Mac, McLean, Va., said the sector’s growth could moderate through the remainder of 2022.

MISMO Launches Commercial Green Borrower Questionnaire

MISMO®, the real estate finance industry standards organization, announced availability of its Commercial Green Borrower Questionnaire.

Commercial/Multifamily Briefs, August 11, 2022

News in brief from NewPoint Real Estate Capital, Walker & Dunlop.