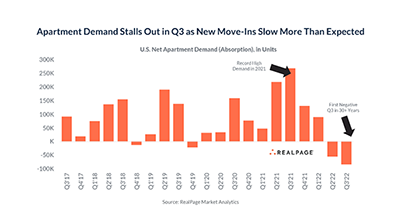

RealPage, Richardson, Texas, said apartment demand plunged in the third quarter as new leasing stalled far more than expected.

Category: News and Trends

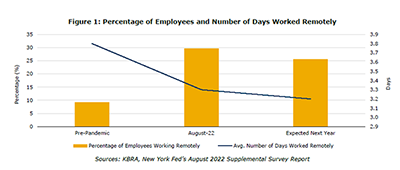

Economic Uncertainty, Remote Work Challenge Office Sector

Despite five interest rate increases in 2022, inflation remains near multi-year highs. This could hit the office sector harder than other property types, said KBRA, New York.

Commercial/Multifamily News Briefs Oct. 20, 2022

News in brief from Freddie Mac Multifamily, Eastdil Secured, Project Destined and Enterprise Community Partners

Commercial and Multifamily People in the News Oct. 20, 2022

Personnel News from CBRE, JLL and Newmark.

Quote

“Commercial and multifamily mortgages continued to perform well through the third quarter. A much smaller share of loans backed by the property types hardest hit at the onset of the pandemic–lodging and retail–were delinquent. For those property types, very few new loans faced difficulties and lenders continued to work through those that had. Additionally, loans backed by property types that have been performing well throughout the pandemic including multifamily, industrial and office continued to see few delinquencies.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

MBA CREF Policy Update Oct. 20, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

CREF Returns to San Diego, Feb. 12-15

The Mortgage Bankers Association’s Commercial Real Estate Finance/Multifamily Housing Convention & Expo takes place Feb. 13-16 at the Manchester Grand Hyatt in San Diego.

RealPage: Apartment Demand Plunges in Third Quarter

RealPage, Richardson, Texas, said apartment demand plunged in the third quarter as new leasing stalled far more than expected.

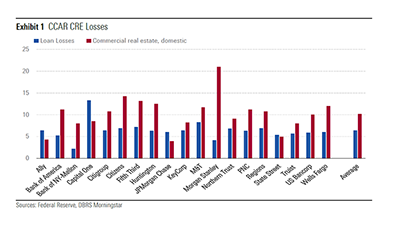

DBRS Morningstar: Federal Reserve Finds CRE Risk

The good news: all 34 banks the Federal Reserve’s recent stress tests examined passed. The not-so-good news: the tests found potential risks in certain loan portfolios including commercial real estate, said DBRS Morningstar, New York.

Dealmaker: JLL Closes $388M New York Multifamily Sale

JLL, Chicago, sold a $387.5 million multifamily community with 408 market-rate units and 9,693 square feet of commercial space in Manhattan’s Murray Hill neighborhood.