The real estate market is bifurcating, the Urban Land Institute and PwC US reported. Some aspects are reverting to pre-covid patterns while others have permanently shifted to the post-pandemic new normal.

Category: News and Trends

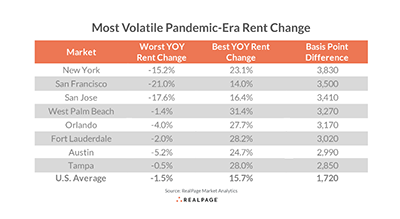

RealPage: Gateway Markets See More Volatile Apartment Rents

The COVID pandemic hit apartment markets nationwide, but different markets saw very different effects, reported RealPage, Richardson, Texas.

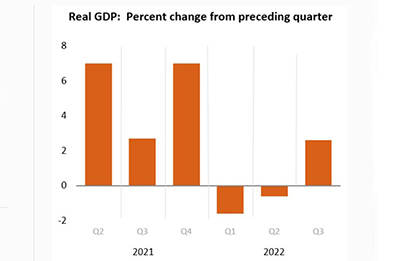

Robust Spending Boosts 3Q GDP

After two quarters in negative territory, real U.S. gross domestic product swung positive in the third quarter, according to the first (advance) estimate released by the Bureau of Economic Analysis last Thursday.

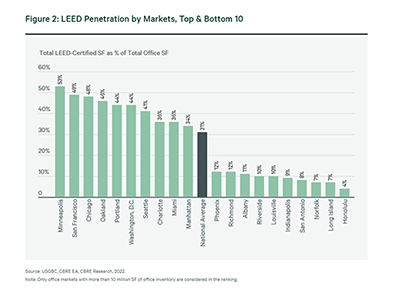

LEED-Certified Office Buildings Command Higher Rents

CBRE, Dallas, reported LEED-certified office buildings command a rent premium over their non-certified peers as the market endures the reverberations of the COVID-19 pandemic and remote work.

Dealmaker: Barings Provides $12M For Brooklyn Affordable Housing Property

Barings, Charlotte, N.C., provided $11.5 million in permanent financing for Euclid Glenmore Apartments, an affordable multifamily housing development in Brooklyn’s East New York neighborhood.

Institutional Real Estate Returns Shrink in Q3

The National Council of Real Estate Investment Fiduciaries reported institutional-quality commercial real estate returned 0.57% in the third quarter, down from 3.24% in the second quarter.

Katie Parsons of JLL on Today’s Industrial Sector

Katie Parsons is Managing Director and Head of the Industrial Sector for JLL Valuation Advisory, which conducts assignments throughout the United States across property types.

Commercial/Multifamily News Briefs Nov. 3, 2022

News in brief from HUD, Strawberry Fields REIT, Aeon Investments.

Commercial and Multifamily People in the News Nov. 3, 2022

Personnel News from Transwestern, Walker & Dunlop and JLL.

Quote

“We’ve moved from a period of ‘irrational exuberance’ to more realistic values as of today in the industrial markets. The days of throwing out a number to win a deal and penciling it out afterwards ended in first-quarter 2022. Current values still indicate that industrial is outperforming many other sectors, bolstered by incredibly low vacancy in the sector, which allows for significant rent growth to still occur and at least partially offset capitalization rate expansion.”

–Katie Parsons, Managing Director and Head of the Industrial Sector for JLL Valuation Advisory.