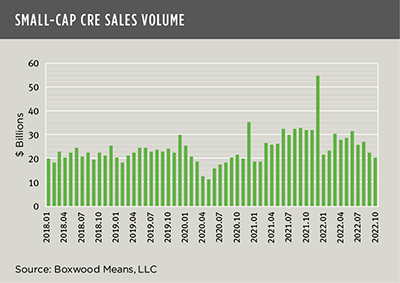

Small-cap commercial real estate market conditions have dimmed–and things will likely get worse before they get better, reported Boxwood Means LLC, Stamford, Conn.

Category: News and Trends

MBA Awards More Than $148,000 in Path to Diversity Scholarships

The Mortgage Bankers Association awarded more than $148,000 in scholarships last year to 167 women and those from historically marginalized and underrepresented groups under its Path to Diversity Scholarship Program.

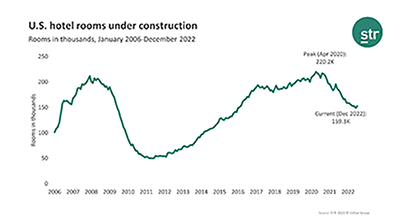

STR: Hotel Construction Up Year-over-Year for First Time Since Late 2020

U.S. hotel construction increased slightly in December after 25 consecutive months of year-over-year declines, reported STR, Hendersonville, Tenn.

ULI: Climate Action Grows More Important Despite Economic Challenges

Climate change will be a central theme for the real estate industry this year, more than 50 sustainability experts told the Urban Land Institute, Washington, D.C.

Yardi Matrix: Record Student Housing Performance Last Year

The student housing industry is positioned for solid performance in 2023 after posting record returns last year, the latest National Student Housing Report from Yardi Matrix said.

Commercial/Multifamily Briefs Jan. 26, 2023

Commercial and multifamily briefs from Dwight Capital, Freddie Mac.

CMF Quote of the Week: Jan. 26, 2023

“Last year’s halt to accommodating interest rates by the Federal Reserve, punctuated chiefly by a series of extraordinary increases in the Fed Funds rate targeting deepening inflation, has curbed the commercial real estate market’s expansion and long-standing stability.”

–Randy Fuchs, Principal and Co-Founder of Boxwood Means, Stamford, Conn.

Commercial and Multifamily People in the News Jan. 26, 2023

Personnel News from RCLCO, BWE.

MBA CREF Policy Update Jan. 26, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

MBA #CREF23 in San Diego Feb. 12-15

Join thousands of your commercial and multifamily real estate colleagues in San Diego for the MBA Commercial/Multifamily Finance Convention & Expo, Feb 12-15.