“Transaction volumes remain low, but our estimates put the bid price about 15% lower than it was a year ago.”

–Peter Rothemund, Co-Head of Strategic Research at Green Street.

“Transaction volumes remain low, but our estimates put the bid price about 15% lower than it was a year ago.”

–Peter Rothemund, Co-Head of Strategic Research at Green Street.

The MBA Commercial/Multifamily Finance Servicing and Technology Conference will kick off with an expert panel of executives exploring the pace of change in office space.

Softening operating performance, elevated inflation, labor shortages and decelerating rental rates have produced the most challenging environment for the single-family rental sector yet, reported KBRA, New York.

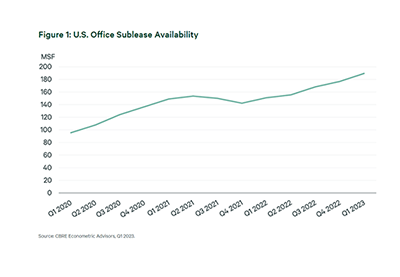

CBRE, Dallas, said office sublease space has nearly doubled since the COVID pandemic began in early 2020, ushering in hybrid working arrangements.

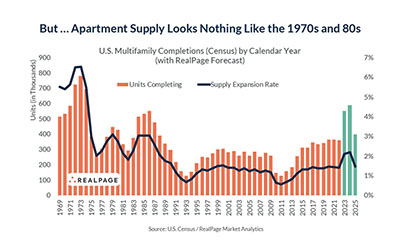

Multifamily construction is currently at its highest level in decades. But it might have less effect on the sector than you think, reported RealPage, Richardson, Texas.

The MBA Commercial/Multifamily Finance Servicing and Technology Conference will kick off with an expert panel of executives exploring the pace of change in office space.

Mass adoption of cloud computing and artificial intelligence is driving exponential growth for data centers, reported JLL, Chicago.

Hotel developers show confidence in upper-upscale properties despite the segment’s slow recovery from the COVID downturn, reported STR, Hendersonville, Tenn.

Briefs from Freddie Mac Multifamily, Standard Real Estate Investments LP, GCM Grosvenor.

Commercial and multifamily developments and activities from MBA important to your business and our industry.