Commercial and multifamily briefs from ULI, StorageCafe and CBRE.

Category: News and Trends

CMF Quote of the Week: May 18, 2023

“What brought back the securitization industry is the New York Fed saying ‘we are going to back the senior bonds; we’ll create more structure, create new oversite and make it a little bit tighter.’ That created and improved the CMBS industry we see today. If it wasn’t for groups like the MBA working with the New York Fed, the CMBS industry would not have been revived.”

–Alan Kronovet Jr., CCMS, Head of Commercial Mortgage Servicing with Wells Fargo Bank, Charlotte, N.C.

CREF Policy Update: May 18, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Commercial and Multifamily People in the News May 18, 2023

Personnel News from Greystone Housing Impact Investors, KBRA and Berkadia.

Vote: MBA.org Finalist for Website of the Year

mba.org has been chosen as one of three finalists for the 2023 Sitefinity Website of the Year Awards. MBA members can vote to ensure mba.org is the winner.

#MBACMST23: Facing up to Office Sector Challenges

CHICAGO–The office sector faces major challenges, but servicers and asset managers can handle them, panelists said here at the MBA Commercial/Multifamily Finance Servicing and Technology Conference.

MBA Recognizes 17 New Commercial Certified Mortgage Servicer Graduates

CHICAGO–MBA Education, the award-winning education division of the Mortgage Bankers Association, recognized 17 individuals who earned the Commercial Certified Mortgage Servicer (CCMS®) designation at a ceremony held at its 2023 Commercial/Multifamily Finance Servicing and Technology Conference.

CBRE: Multifamily Fundamentals Begin to Stabilize

The U.S. multifamily sector is beginning to stabilize as vacancy rate expansion and negative absorption ease, reported CBRE, Dallas.

MBA: 1st Quarter Commercial/Multifamily Borrowing Down 56%

Commercial and multifamily mortgage loan originations fell by 56 percent in the first quarter from a year ago, and fell by 42 percent from the fourth quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

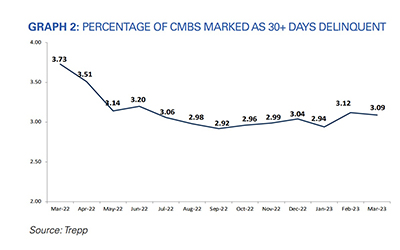

CMBS Delinquency Rate Dips; Offices See Increase

The commercial mortgage-backed securities delinquency rate fell slightly in March, but the segment that everyone watches closely–office–saw its rate move higher again, reported Trepp, New York.