“The increase to the threshold–along with a new method to review it on an annual basis–will help to ensure that HUD multifamily financing is a viable option at all times during the lending cycle.”

–MBA President and CEO Bob Broeksmit, CMB

“The increase to the threshold–along with a new method to review it on an annual basis–will help to ensure that HUD multifamily financing is a viable option at all times during the lending cycle.”

–MBA President and CEO Bob Broeksmit, CMB

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Enterprise Community Partners, Columbia, Md., named Shaun Donovan its new CEO and President, effective Sept. 1.

The Federal Open Market Committee held rates steady at its June meeting but kept its options open for July and later this year.

Eastern Mortgage Capital, Burlington, Mass., provided $40.5 million in permanent financing for Vantage St. Pete, a 211- unit mid-rise apartment community in St. Petersburg, Fla.

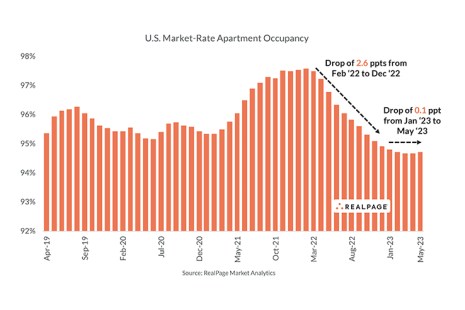

Apartment occupancy is holding steady year-to-date so far in 2023, with May’s apartment occupancy rate at 94.7%–and flat from April, RealPage, Richardson, Texas, reported.

The Federal Housing Finance Agency released its 2022 Report to Congress last week.

MBA Education announced Rodrigo Lopez, CMB, Chairman of AmeriSphere Companies and MBA’s 2017 Chairman, will lead its Commercial/Multifamily Future Leaders Program beginning October 17, 2023.

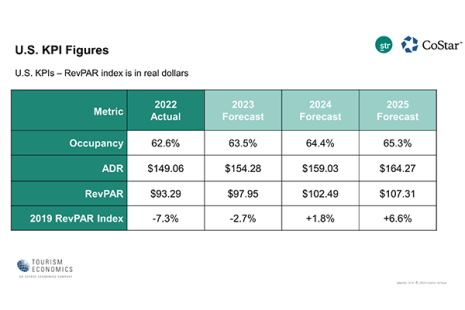

STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa., upgraded their hotel sector forecast for the rest of 2023.

Briefs from HUD, Boxwood Means, Fannie Mae and Enterprise Community Partners.