Donald Billingsley was named as Associate Deputy Assistant Secretary for Multifamily Housing at the U.S. Department of Housing and Urban Development.

Category: News and Trends

July 24 (New Date) MBA Education Webinar Office Doldrums: Challenges, Opportunities and Nuances

Office markets and performance are on the minds of market participants as technology layoffs and space reduction announcements drive the year’s news cycles along with rising interest rates. Join MBA Education and industry practitioners as they explore opportunities and challenges in the office sector.

CMF Quote of the Week: July 13, 2023

“The supply of low-rent units has fallen continuously in the past decade due to rent increases in existing units, tenure conversions out of the rental stock, building condemnations, and demolitions.”

–Harvard Research Analyst Sophia Wedeen.

CREF Policy Update: July 13, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Commercial/Multifamily Briefs, July 6, 2023

CBRE announces new partnership with Howard University; the Altman Cos. launches Altman Living.

Dealmaker: BWE Secures $36M for Acquisition, Renovation of Indiana University Student Housing

Bellwether Enterprise, Cleveland, secured $36 million in acquisition financing for a student housing property at Indiana University in Bloomington, Ind.

Fitch Ratings: NOI Growth for CMBS Properties Sees Good 2022, but Slower 2023 Likely

Fitch Ratings, New York, reported property-level net operating income for loans securitized within Fitch-rated U.S. multi-borrower CMBS grew 6.3% in 2022, but warned that kind of growth likely won’t be sustainable this year.

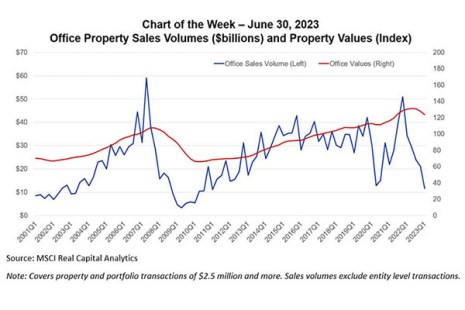

MBA Chart of the Week July 6, 2023: Office Property Sales Volumes and Values

In commercial real estate, all eyes remain on the office market. That is despite the fact that multifamily mortgage debt – accounting for $2.0 trillion of the $4.6 trillion of total outstanding — is almost three times as large and office accounts for just 17 percent of total CRE debt.

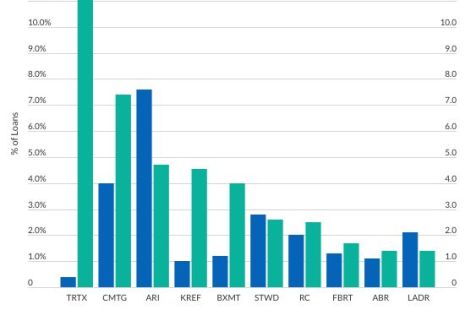

Fitch: Commercial mREIT Sector Faces Further Pressures in 2023

Fitch Ratings, New York, said commercial mortgage real estate investment trust ratings will continue to be challenged by post-pandemic occupancy rates, “with growing recessionary risks and further deterioration of commercial real estate fundamentals.”