Apartment asking rents climbed by $12, or 0.6%, from May to June, reported Zillow, Seattle.

Category: News and Trends

MBA CREF24 Registration Opens

Make plans to attend the commercial/multifamily industry event of the year: #MBACREF24, taking place February 11-14 in San Diego. Register by August 31 to take advantage of last year’s rates.

New Date, July 24: MBA Education Webinar Office Doldrums: Challenges, Opportunities and Nuances

Office markets and performance are on the minds of market participants as technology layoffs and space reduction announcements drive the year’s news cycles along with rising interest rates. Join MBA Education and industry practitioners as they explore opportunities and challenges in the office sector.

CREF Policy Update: July 20, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CMF Quote of the Week: July 20, 2023

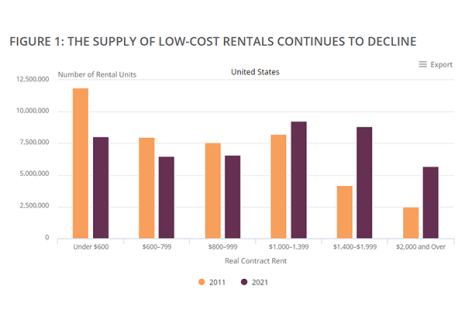

“The supply of low-rent units has fallen continuously in the past decade due to rent increases in existing units, tenure conversions out of the rental stock, building condemnations, and demolitions.”

–Harvard Research Analyst Sophia Wedeen.

New Date, July 24: MBA Education Webinar Office Doldrums: Challenges, Opportunities and Nuances

Office markets and performance are on the minds of market participants as technology layoffs and space reduction announcements drive the year’s news cycles along with rising interest rates. Join MBA Education and industry practitioners as they explore opportunities and challenges in the office sector.

Construction Spending Increases for Fifth Consecutive Month

The Census Bureau reported construction spending increased in May to a seasonally adjusted annual rate of $1,925 billion, 0.9 percent above the bureau’s revised April estimate.

Dealmaker: Gantry Secures $12M to Refinance Affordable Multifamily Property Near Seattle

Gantry, San Francisco, secured a $12.1 million permanent loan to refinance an apartment property in Auburn, Wash., in the Seattle suburbs.

RCLCO: Sentiment Improves, but Still Points to Recession Worries

RCLCO, Washington, D.C., said its mid-year Sentiment Survey found an uptick in its Current Real Estate Market Sentiment Index to 19 from a low of 8.3 at the end of 2022. However, survey respondents still believe a recession is likely, even as many measures slowly begin to improve.

Low-Cost Rentals Have Decreased in Every State, Harvard Finds

The supply of low-cost rental apartments fell by 3.9 million units over the last decade and in every state, the Harvard Joint Center for Housing studies reported.