Make plans to attend the commercial/multifamily industry event of the year: #MBACREF24, taking place February 11-14 in San Diego. Register by August 31 to take advantage of last year’s rates.

Category: News and Trends

CREF Policy Update: July 27, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CMF Quote of the Week: July 27, 2023

“The Mortgage Bankers Association strongly urges you to vote against the proposed interagency Notice of Proposed Rulemaking implementing the Basel III ‘endgame’ rule. Such a substantial hike will have both macroeconomic and sector impacts that could stunt economic growth and fundamentally shift what business lines mid-sized and regional banks will focus on.”

–MBA President and CEO Robert D. Broeksmit, CMB, in the letter to bank regulators opposing a proposed capital rule.

Commercial/Multifamily People in the News July 27, 2023

Donald Billingsley was named as Associate Deputy Assistant Secretary for Multifamily Housing at the U.S. Department of Housing and Urban Development.

Support the Next Generation of CREF Professionals

The Commercial Real Estate Finance Careers Student Fellowship program provides college students, including those from groups traditionally underrepresented in the industry, with a package of networking and educational opportunities centered on the $4.5 trillion commercial real estate finance industry.

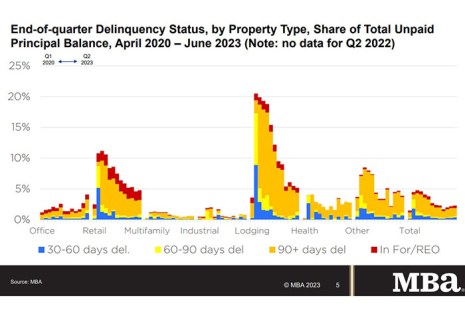

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increase Slightly

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly during the second quarter, the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey reported.

Fitch: Office Property Performance to Worsen Amid Rising Market Pressures

Office loan performance will likely continue to weaken as market pressures build, reported Fitch Ratings, New York.

CBRE: Rapid Global Data Center Growth Despite Power Supply Challenges

CBRE, Dallas, reported that power supply has struggled to keep pace with data center industry growth internationally. Per its Global Data Center Trends 2023 report, that’s continued to keep vacancies low and pushed rents in the sector up, even amid new construction.

Dealmaker: Mesa West Capital Lends $72M to Refinance Suburban Charleston Multifamily

Mesa West Capital, New York, provided Atlanta-based real estate investment firm Audubon with a $71.5 million first mortgage secured by The Cooper, a 344-unit multifamily community in Mount Pleasant, S.C.

MBA Opens Doors Foundation Raises Nearly $235,000 During MBA’s Chairman’s Conference

The MBA Opens Doors Foundation announced it raised $234,536 at its Annual Charity Wine Auction held during MBA’s June Chairman’s Conference in Manalapan, Fla.