Eastern Union, New York, arranged $8.8 million in financing for the purchase of an office complex in Nottingham, Md., near Baltimore.

Category: News and Trends

Call for Speakers – MBA Commercial/Multifamily Finance Convention & Expo 2024

Speaking opportunities for breakout sessions are now being accepted for MBA’s Commercial/Multifamily Finance Convention & Expo 2024 (CREF24), taking place February 11 – 14 at the Manchester Grand Hyatt in San Diego.

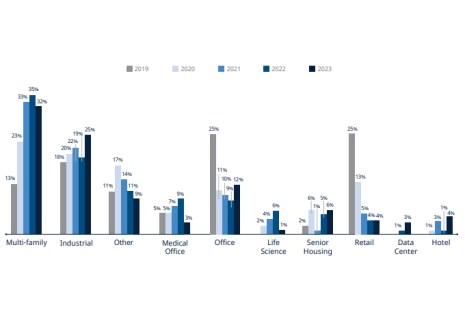

DLA Piper: Commercial Trends Vary by Class

DLA Piper, London, recently released its 2023 Mid-Year Real Estate Trends Report, highlighting activity in multifamily properties, industrial assets and other sectors.

Berkadia: Student Housing Operating Fundamentals Strong

Berkadia, New York, in its 2023 U.S. Student Housing Preleasing Report found student housing operating fundamentals are among the strongest in the commercial real estate sector, with the fall 2023 lease-up cycle the fastest on record.

Amber Rao, Marcy Thomas Discuss MBA’s COMBOG DE&I Council

Amber Rao, CCIM, Vice President with KeyBank Real Estate Capital, and Marcy Thomas, CCIM, CCMS, Vice President, Portfolio Loan Manager with Grandbridge Real Estate Capital, sat down with MBA NewsLink to discuss MBA’s COMBOG DE&I Council.

CMF Quote of the Week: Aug. 10, 2023

“Midway through the year, we are starting to see a return to more normal patterns, although performance is a bit weaker.”

–Sara Hoffmann, Director of Multifamily Research at Freddie Mac.

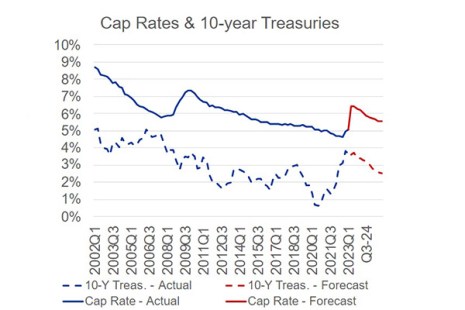

MBA Forecast: Higher Rates, Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending is expected to fall to $504 billion this year, a 38 percent decline from 2022’s $816 billion total. This is according to an updated baseline forecast released by the Mortgage Bankers Association.

MBA: Multifamily Lending Declined 1% in 2022 to $480 Billion

In 2022, 2,242 different multifamily lenders provided a total of $480.1 billion in new mortgages for apartment buildings with five or more units, the Mortgage Bankers Association’s annual report of the multifamily lending market said.

CREF Policy Update: Aug. 3, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

MBA Publishes Expanding Affordable Rental Housing Opportunities: A Progress Update

The Mortgage Bankers Association published a progress report on MBA 2023 Chair Matt Rocco’s priority, Affordable Rental Housing Strategy: Expanding Affordable Rental Housing Opportunities.