On Monday, the Mortgage Bankers Association led a coalition letter sent to the Board of Governors of the Federal Reserve that conveyed the housing industry’s serious concerns about the negative market impacts the Fed’s monetary policy actions (e.g., rate hikes and quantitative tightening) are having on the market.

Category: News and Trends

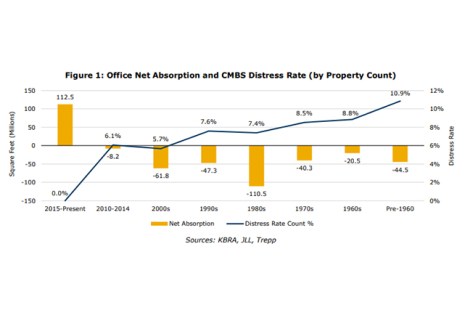

KBRA: Older Office Buildings Struggling

KBRA, New York, said in the current office environment, older buildings are seeing particular challenges.

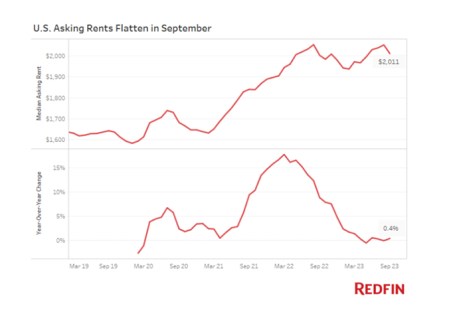

Rents Largely Flat in September, RealPage, Redfin Find

According to RealPage Analytics, Richardson, Texas, and Redfin, Seattle, rents were fairly flat in September.

Dealmaker: Gantry Secures $19M to Refinance Industrial Portfolio

Gantry, San Francisco, secured a $19 million permanent loan to cross-collateralize and refinance the acquisition costs of three single-tenant industrial properties.

Fitch Ratings: Life Insurers Can Withstand Commercial Real Estate Deterioration

Fitch Ratings, New York, said U.S. life insurers’ ratings are not currently at risk from commercial real estate exposure, due to insurers’ stable investment portfolios, conservative underwriting, strong liquidity and effective asset-liability management.

CMF Quote of the Week: Oct. 12, 2023

“Rents have flattened because a boom in apartment building in recent years has flooded the market with supply, but they haven’t yet posted a substantial decline because there’s still demand for rentals—especially as high mortgage rates keep many would-be homebuyers and sellers on the sidelines.”

–Redfin Economics Research Lead Chen Zhao.

CREF Policy Update Oct. 12

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Nov. 9: CREF Career Conversations

Commercial/multifamily finance presents a wide array of career opportunities with its ecosystem of companies, roles, and functions supporting the capital needs of real estate owners and operators. Join MBA Education and industry executives for a discussion to explore career trajectories, pivots, and leadership lessons learned.

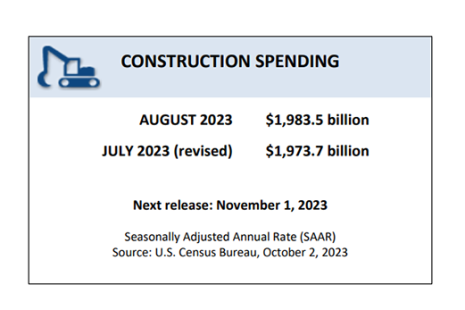

Construction Spending Increases Again

The U.S. Census Bureau reported construction spending increased in August to a seasonally adjusted annual rate of $1,983.5 billion, 0.5 percent above the bureau’s revised July estimate.

MBA Chart of the Week: FOMC Summary of Economic Projections for Fed Funds Rate

In this week’s MBA Chart of the Week, we track changes in policymakers’ quarterly published SEP federal funds rate forecasts over the last eleven quarters.