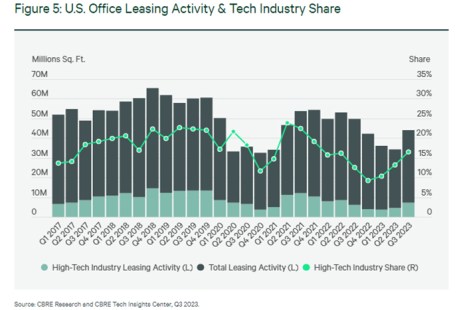

CBRE, Dallas, reported that despite challenges in the sector, the tech industry has reclaimed the largest share of U.S. office leasing in the third quarter.

Category: News and Trends

Dealmaker: Greystone Announces Deals in New Jersey, California

Greystone, New York, announced recent deals in New Jersey and California.

To the Point With Bob: FSOC’s Bid to Regulate Non-Bank Firms Will Harm Consumers, Mortgage Sector

This spring, the Financial Stability Oversight Council (FSOC) issued a proposal that would remove procedural requirements and allow it to fast-track the designation of non-bank financial companies as systemically important financial institutions (“SIFI”) subject to enhanced supervision by the Federal Reserve.

CREF Policy Update Nov. 2

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CMF Quote of the Week: Nov. 2, 2023

“MBA shares the Biden administration’s commitment to increasing housing supply and appreciates its willingness to engage with us and the industry on ways to incentivize lenders and borrowers to rehab, repurpose, and convert more obsolete commercial properties into affordable rental housing and other usable spaces.”

–Robert Broeksmit, CMB, President and CEO of the Mortgage Bankers Association

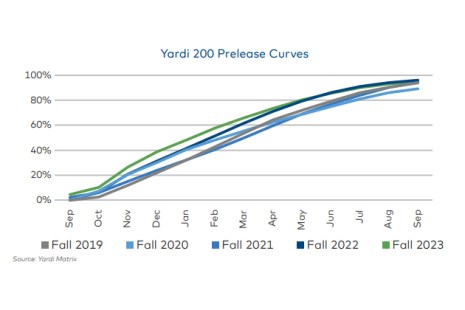

Yardi Matrix: Student Housing Down From 2022, but Still Sees Strong Numbers

Yardi Matrix, Santa Barbara, Calif., reported 95.1% of beds at its “Yardi 200” universities were preleased as of the end of September.

Nov. 9: CREF Career Conversations

Commercial/multifamily finance presents a wide array of career opportunities with its ecosystem of companies, roles, and functions supporting the capital needs of real estate owners and operators. Join MBA Education and industry executives for a discussion to explore career trajectories, pivots, and leadership lessons learned.

MBA’s Future Leaders Program Graduates 74 Real Estate Finance Professionals

PHILADELPHIA–The Mortgage Bankers Association recognized 74 mortgage professionals – 35 from the residential market segment and 39 from the commercial/multifamily market segment – in a graduation ceremony for MBA’s Future Leaders Program held here at MBA’s 2023 Annual Convention & Expo.

Dealmaker: Berkadia Brokers $71M Georgia Apartment Sale

Berkadia, New York, brokered the sale of Grace Apartment Homes Roswell, a 396-unit garden-style multifamily property in Roswell, Ga., for $70.5 million.

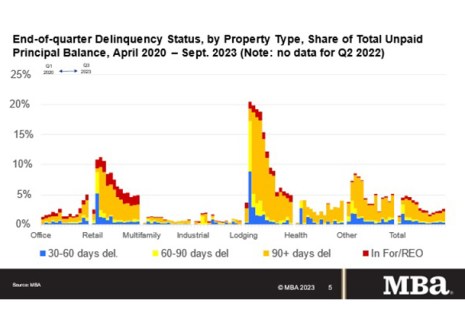

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increased Slightly in Third Quarter

Delinquency rates for mortgages backed by commercial and multifamily properties increased during the third quarter of 2023, according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey.