Commercial and multifamily mortgage loan originations were 49% lower in the third quarter of 2023 compared to a year ago, and decreased 7% from the second quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Category: News and Trends

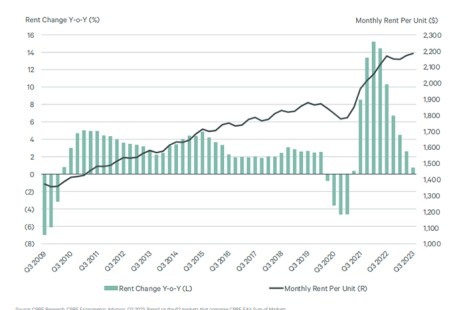

CBRE: Multifamily Rent Growth Slows in Q3

CBRE, Dallas, found that average multifamily rent growth slowed to 0.7% year-over-year in the third quarter amid an influx of deliveries of new units.

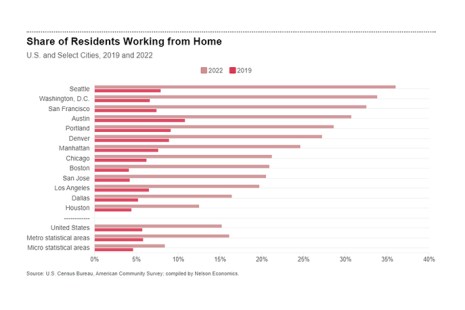

Urban Land Institute, PwC Report: New Norms Emerging in Industry

The Urban Land Institute, Washington, D.C., and PwC, London, released their annual Emerging Trends in Real Estate 2024 report, highlighting the “Great Reset” present in the industry.

Commercial/Multifamily Briefs, Nov. 9, 2023

Industry news from M&T Realty Capital Corp., City First Bank, NewPoint and HUD.

CMF Quote of the Week: Nov. 9, 2023

“Year-to-date CRE mortgage borrowing has fallen 44%, driven by questions about some properties’ fundamentals, uncertainty about property values, and higher and volatile interest rates.”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research

CMBS Delinquency Rate Dips, KBRA Reports

The delinquency rate among KBRA-rated commercial mortgage-backed securities dipped four basis points in October to 4.21%, the rating agency reported.

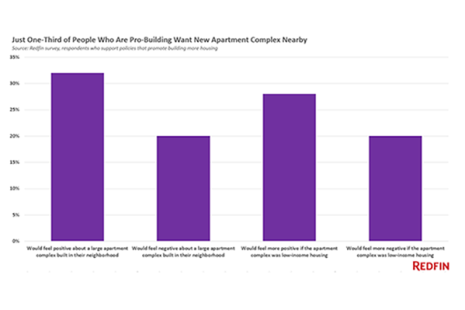

Redfin: Most Respondents Support More Housing, But Many Don’t Want Apartments in Their Neighborhood

A recent Redfin survey finds that nearly 80% of respondents support policies that promote building more housing.

HUD, Biden Administration Encourage More Commercial-to-Residential Conversions; MBA Weighs In

On Friday, HUD and the Biden Administration announced two updates to increase housing supply and improve housing affordability, including research on commercial-to-residential conversions. Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, weighed in on the announcement.

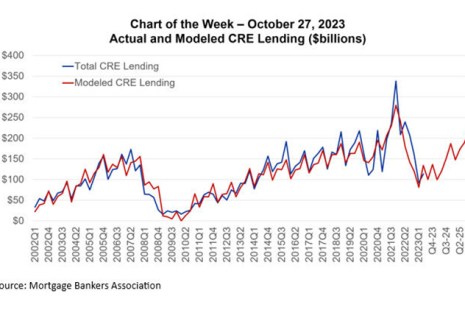

MBA Chart of the Week: Actual and Modeled CRE Lending ($Billions)

MBA’s latest commercial real estate finance (CREF) forecast anticipates 2023 origination volumes ($442 billion) will come in just a bit more than half of what they were in 2022 ($816 billion).

MBA NewsLink Multifamily Roundtable: High Rates, Stalled Rents and New Roofs

As uncertainty dominates discussions about getting deals done, MBA NewsLink convened three multifamily finance executives, Chad Musgrove, John Lloyd and Carl McLaughlin, to get their opinions on where the apartment industry sits and where it’s headed next.