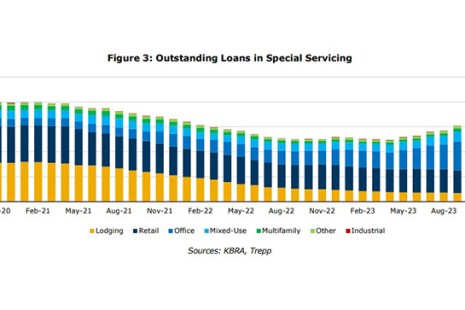

KBRA, New York, said the delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased 19 basis points in November to 4.4%.

Category: News and Trends

Arbor: Single-Family Rental Investment Sector Remains Strong

Arbor, Uniondale, N.Y., released its Single-Family Rental Investment Trends Report for the fourth quarter, highlighting a strong landscape for SFR/build-to-rent construction in the second quarter.

CREF Policy Update Dec. 7: SEC Issues Conflicts of Interest Final Rule

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Dealmaker: Berkadia Secures $96M in California, Indiana

Berkadia, New York, secured $96.9 million in financing for multifamily properties in California and Indiana.

MBA: Commercial Mortgage Delinquency Rates Increased in Third Quarter

Commercial mortgage delinquencies increased in the third quarter, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

Commercial/Multifamily Briefs, Dec. 7 2023

Commercial and multifamily industry news from Enterprise Community Partners and Freddie Mac.

CMF Quote of the Week: Dec. 7, 2023

“Not unexpectedly, delinquency rates on commercial mortgages increased for the third consecutive quarter,”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research

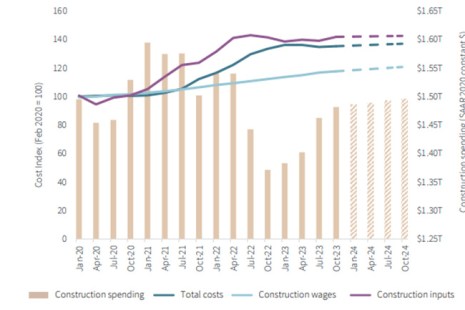

JLL: Construction Industry Likely to See Positive 2024

JLL, Chicago, released its U.S. and Canada Construction Trends 2024 forecast, positing that the industry will have a positive 2024, but also acknowledging existing challenges.

Fitch Shifts Its Outlook for U.S. Title Insurers to Neutral in 2024

Fitch Ratings, New York, shifted its sector outlook for the U.S. title insurance market to neutral for 2024.

Anne Hill from Bayview PACE: Eight Reasons Banks are Warming up to C-PACE Financing

These can be challenging times for commercial real estate borrowers facing tight credit markets. It’s also stressful for banks who want to help their clients but are limited in what they can do. Enter C-PACE.