The Mortgage Bankers Association’s Affordable Housing Initiative has expanded opportunities for members to stay engaged in affordable multifamily and homeownership efforts by launching an Affordable Housing Newsletter, online affordable housing communities and an Affordable Housing Insights webinar and interview series.

Category: News and Trends

Deadline Extended: Nominate Someone for MBA NewsLink Tech All-Star Award

The deadline for the MBA NewsLink 2024 Tech All-Star Awards nomination period has been extended.

CREF Policy Update Feb. 1: FHA Publishes Multifamily Loan Limits and High-Cost Threshold

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CMF Quote of the Week: Feb. 1, 2024

“U.S. average daily rates and revenue per available room reached record highs in 2023 with solid travel fundamentals and a big year for group business underpinning performance.”

–STR President Amanda Hite

MBA NewsLink Q&A with Berkadia’s JV Equity & Structured Capital Group

MBA NewsLink recently interviewed Chinmay Bhatt, Noam Franklin and Cody Kirkpatrick from Berkadia’s JV Equity & Structured Capital Group about the state of the equity market.

MBA CREF Forecast: Commercial/Multifamily Borrowing and Lending Expected to Increase to $576 Billion in 2024

Total commercial and multifamily mortgage borrowing and lending is expected to rise to $576 billion in 2024, which is a 29% increase from 2023’s estimated total of $444 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association (MBA).

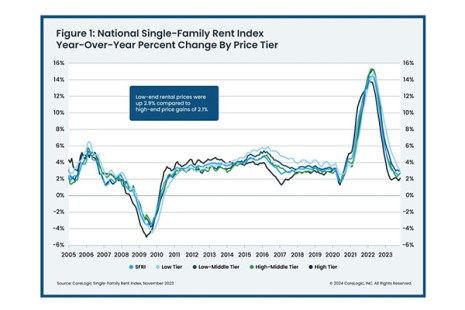

CoreLogic: Single-Family Rent Growth Continues Stable Pace

CoreLogic, Irvine, Calif., in its latest Single-Family Rent Index, found national single-family rent growth remained stable in November at 2.7%.

Dealmaker: Peachtree Group Originates $73M for Construction, CPACE Financing for San Diego Hotel

Peachtree Group, Atlanta, announced it originated $73 million in a construction loan and CPACE financing for the development of a 263-room dual-brand Home2 Suites and Tru by Hilton Hotel in San Diego.

New MBA Commercial Property Inspection Form Reflects Industry Collaboration

As of Jan. 1, a new property inspection form now exists for use within the commercial real estate industry. Part of an industry and MBA effort, the new form is called the MBA Standard Inspection Form.

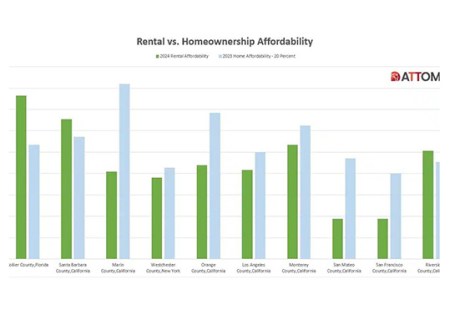

Renting, Buying Both Prompt Affordability Concerns, ATTOM Finds

ATTOM, Irvine, Calif., released its 2024 Rental Affordability Report, showing median three-bedroom rents in the U.S. are more affordable than owning a similarly sized home in the vast majority of local markets.