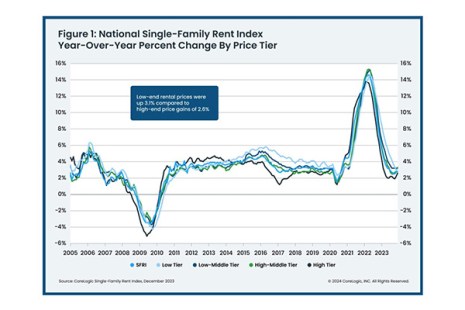

“Single-family rent growth should remain in the range of about 2% to 4% for 2024.”

–Molly Boesel, Principal Economist for CoreLogic.

“Single-family rent growth should remain in the range of about 2% to 4% for 2024.”

–Molly Boesel, Principal Economist for CoreLogic.

CoreLogic, Irvine, Calif., found single-family rent growth was consistent with pre-pandemic trends in December, with a 2.8% increase year-over-year.

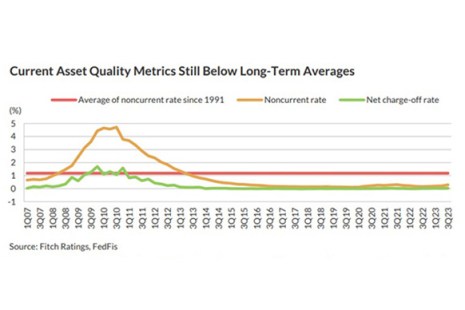

Fitch Ratings, New York, said it expects banks’ asset-quality metrics to deteriorate for certain U.S. multifamily loans as borrowers will face elevated risks from higher refinancing rates and valuation pressures as loans mature over the next few years.

CBRE Hotels is forecasting hotel revenue per available room will continue to grow steadily this year, driven by improving group business, inbound international travel and traditional transient business demand.

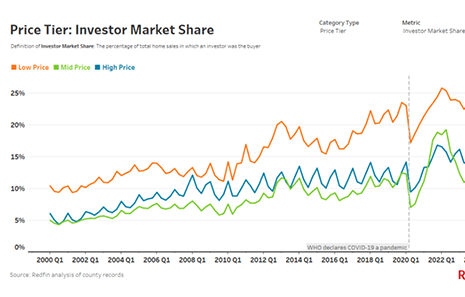

Real estate investors bought just over 26% of the low-priced homes that sold in the fourth quarter–the highest share on record, according to Redfin, Seattle.

MISMO, the real estate finance industry’s standards organization, today issued a call for industry professionals to join a new development work group focused on creating a servicing data standard for Federal Housing Agency loans. The Federal Housing Agency Servicing Dataset workgroup effort is powered by Sagent.

SAN DIEGO–Why aren’t we as brave and confident as we were when we were kids?

Commercial and multifamily developments and activities from MBA important to your business and our industry.

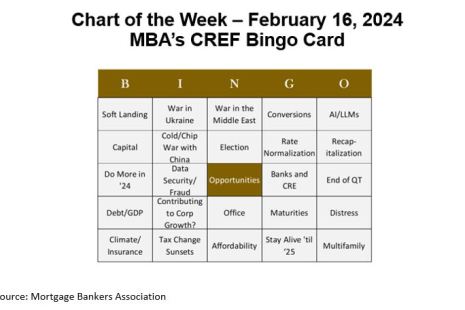

Many of us recently returned from a week in San Diego at MBA’s Commercial Real Estate/Multifamily Finance Convention and Expo, where 2,000-plus CRE mortgage professionals gathered to hear from speakers, discuss policy issues, network, and – most importantly – begin the year’s deal-making in earnest.

JLL Capital Markets, Chicago, arranged the $32 million sale and $25 million in financing for an outpatient medical building portfolio totaling 80,315 square feet in Arizona.