Real Capital Analytics, New York, reported the annual rate of decline in U.S. commercial property prices slowed in early 2024.

Category: News and Trends

MBA Creates Member Guide Ahead of Partial Government Shutdown Possibility

As of this writing, the federal government is on the brink of a partial shutdown with the first deadline of the current two-tiered Continuing Resolution rapidly approaching. Congressional leaders on Wednesday evening agreed to extend the current agreement for a short time–until March 8 for some federal departments and March 22 for others.

MBA NewsLink Q&A with Daron Tubian of Barings, Chair of the 2024 Affordable Rental Housing Advisory Council

Daron Tubian was named Chair of the 2024 Affordable Rental Housing Advisory Council at CREF24 in San Diego. Tubian previously co-chaired the Council in 2023.

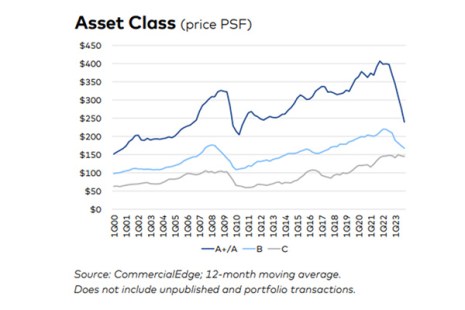

CommercialEdge: Office Market Continues to See Challenges

CommercialEdge, Santa Barbara, Calif., found the average U.S. office listing rate was at $37.35 per square foot, down about 1.8% year-over-year, in January. That’s also down about 29 cents from December.

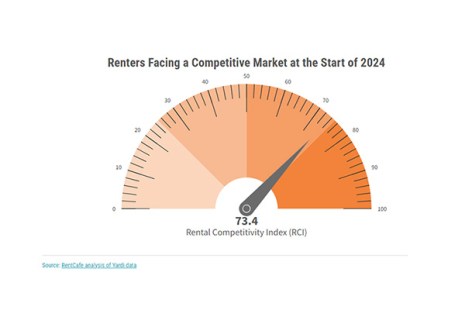

Miami No. 1 Rental Market, RentCafe Finds

RentCafe, Santa Barbara, Calif., compiled a report on the hottest rental markets for the beginning of 2024, finding Miami takes the top spot, but many markets in the Midwest are also popular.

Economic Outlook: ‘Some Momentum’ Going into 2024–#MBAServicing24

ORLANDO–The U.S. economy was stronger in 2023 than most analysts expected, according to Joel Kan, Vice President and Deputy Chief Economist with the Mortgage Bankers Association.

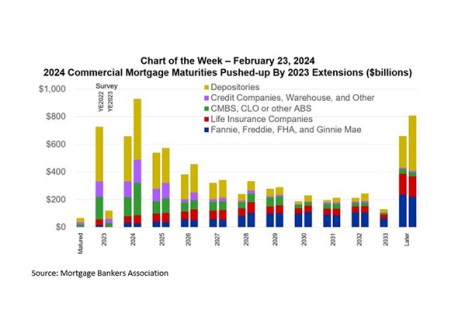

MBA Chart of the Week: 2024 Commercial Mortgage Maturities Pushed Up by 2023 Extensions

Commercial mortgages tend to be relatively long-lived, spreading maturities out over several years.

CREF Policy Update Feb. 29: Fight for LIHTC! MBA’s National Advocacy Conference on March 19-20

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Dealmaker: Ease Capital Provides $32M in Bridge Financing for Virginia Beach Multifamily

Ease Capital, New York, provided Community Investment Group, Chesapeake, Va., with $32 million for the purchase and renovation of Dove Landing Apartments, a 318-unit garden-style multifamily community in Virginia Beach, Va.

FY2024 Government Funding Update

The first deadline of the current two-tiered Continuing Resolution (CR) is Friday, March 1, 2024.