Fitch: Stagflation Threatens Commercial Real Estate Values

Stagflation could lead to lower U.S. commercial real estate valuations, said Fitch Ratings, New York.

“Inflation and weak economic growth could result in modestly growing or declining nominal net operating income from soft tenant demand and elevated capitalization rates reflecting a higher risk premium,” Fitch said in U.S. Commercial Real Estate Values Threatened by Stagflation.

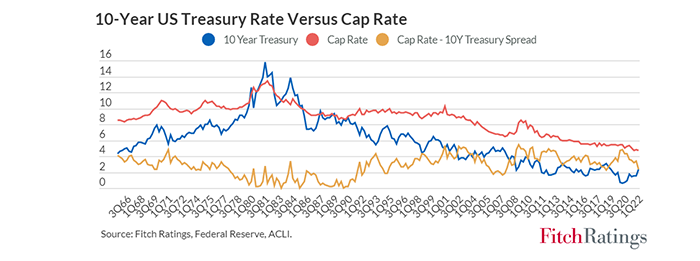

The report noted changes in nominal commercial real estate values typically come with similar NOI movements and said values increase in most sustained rising interest rate periods. “During these periods of rising long-term interest rates, property-level cash flows tend to keep pace with, or grow faster than, the increase in cap rates,” Fitch said. “However, stagflation could result in a prolonged period of elevated cap rates, which would likely result in declines in commercial real estate values.”

The report said the positive correlation between cap rates and the 10-year Treasury yield has weakened since the 1980s, clouding the relationship between cap rates and interest rates. “However, lower going-in values are required to account for higher financing costs with unchanged cash flows, loan-to-value ratios and internal rates of returns,” Fitch said. “The spread between cap rates and 10-year Treasury rates generally tightens when 10-year Treasury rates increase and increases when Treasuries decline. Cap rates also tend to be ‘sticky,’ or less volatile than risk-free rates, thus the cap rate spread serves as a shock absorber to Treasury movements.”