MBA Charts of the Week: 2018 HMDA Respondents

Source: 2013-2018 Home Mortgage Disclosure Act (HMDA)–preliminary analysis.

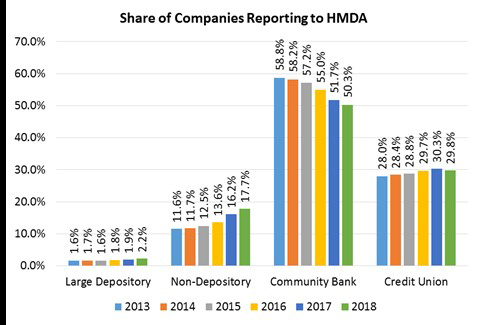

A total of 5,189 institutions reported lending activity under the Home Mortgage Disclosure Act during 2018. Broken down by lender size, large depositories are defined as depository institutions with $10 billion or more in assets, and community banks are defined as depositories with less than $10 billion in assets.

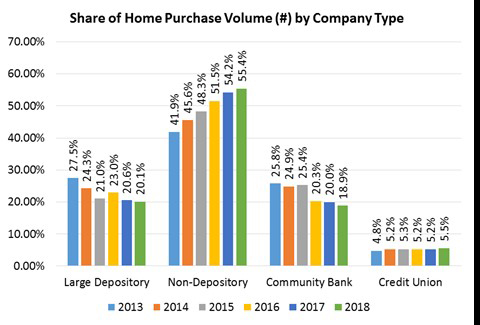

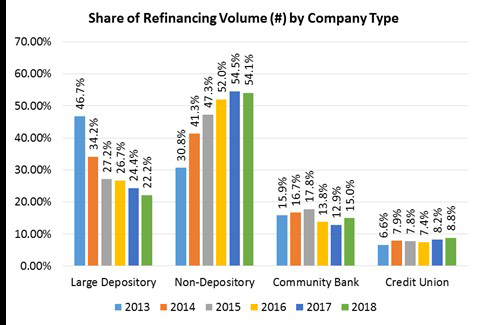

Last year, there was a slight uptick in the number and share of large depositories reporting to HMDA, but their share of both home purchase and refinance originations was down compared to 2017 (see charts below). Community banks saw a decrease in the number and share of companies reporting–likely due to continued industry consolidation–but saw an increase in their share of refinance originations.

The number of non-depositories reporting to HMDA also increased, as well as their share of home purchase originations. However, non-depositories’ share of refinance originations fell for the first time in seven years. The number of reporting credit unions also declined, but they experienced slight gains in their share of both home purchase and refinance volume.

Source: 2013-2018 Home Mortgage Disclosure Act (HMDA)–preliminary analysis.

Volume charts are based on the following set of exclusions that MBA imposes on the HMDA data: single-family (1-4 unit), closed-end (or exempt) and first-lien loans that are originated through the retail or broker channels, excluding ‘home improvement’ loans and loans with “other” or “unknown” purposes. Note that these exclusion criteria may result in differences from HMDA statistics reported elsewhere.

In 2018, non-depositories continued their decade-long trend of gaining share of the home purchase market, increasing to 55.4 percent of volume from 54.2 percent in 2017. Non-depositories’ share of refinance originations dipped to 54.1 percent from 54.5 percent in 2017, but they still maintain a significantly higher share of refinance activity than large depositories. Community banks saw the largest increase in refinance share in 2018, increasing to 15.0 percent of volume, their highest share since 2015.

Learn more about MBA’s HMDA data analyses, and click https://store.mortgagebankers.org/ProductDetail.aspx?product_code=DP6-305055-19-I&_ga=2.95847580.102827731.1569352729-475930019.1559321405 to pre-order the 2019 HMDA Residential Originations Databook.

–Jon Penniman (jpenniman@mba.org); Joel Kan (jkan@mba.org).