MBA Chart of the Week: Percent of IMBs with Pre-Tax Net Income

Source: MBA’s Quarterly Mortgage Bankers Performance Report: www.mba.org/performancereport

This past week, MBA Research released the second quarter results of its Quarterly Mortgage Bankers Performance Report. After a weak start to the year, production profitability improved in the second quarter as volume picked up. However, production profits were down on a year-over-year basis and fell below typical second quarter results.

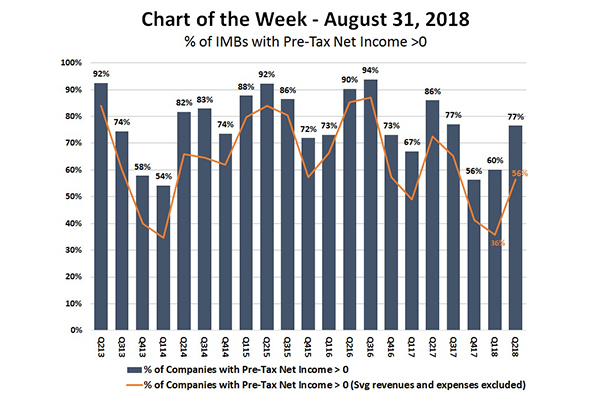

This Chart of the Week compares the percentage of companies in the Performance Report that reported positive pre-tax net income including all lines of business (e.g. production and servicing operations), versus the percentage of companies that reported positive pre-tax net income, once servicing operations are excluded.

In the second quarter, 77 percent of the 346 independent mortgage bankers and mortgage subsidiaries of chartered banks posted overall positive pre-tax net income, an improvement from the 60 percent of companies reported for the first quarter. Once any ongoing revenues and expenses associated with holding mortgage servicing rights are excluded, the percentage of companies reporting pre-tax net financial profits falls to 56 percent in second quarter, after being at 36 percent in the first quarter.

Across all quarters in the Performance Report, mortgage servicing lifted a portion of companies in our total sample to positive pre-tax net income, which suggests that a natural hedge between production and servicing operations still exists for independent mortgage banks.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is associate director of analytics with MBA; she can be reached at jmasoud@mba.org.)