MBA Chart of the Week: Mortgage Delinquency Rates in Texas, Florida

Source: MBA National Delinquency Survey; www.mba.org/nds.

Last week, MBA Research released third quarter results of its National Delinquency Survey. Despite a very healthy economy, the delinquency rate for mortgage loans on one-to-four-unit residential properties was up 11 basis points from the previous quarter, largely as a result of storms affecting the Carolinas, Mississippi, Arkansas and Alabama.

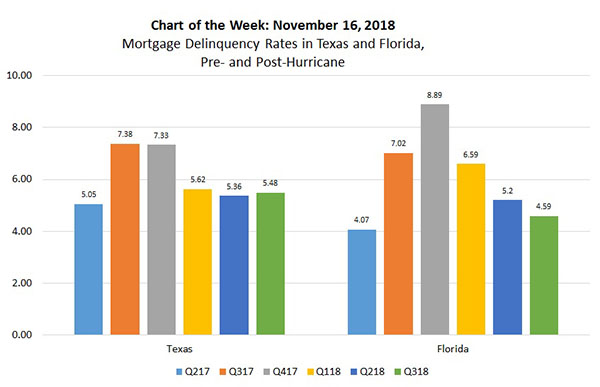

Natural disasters continue to play a major factor in determining whether borrowers make timely mortgage payments. As an example, we show non-seasonally adjusted mortgage delinquency rates in Texas and Florida from second quarter 2017 (before Hurricanes Harvey and Irma) through third quarter 2018 (one-year after the hurricanes).

Following the initial spike, mortgage delinquency rates in both states began to retreat within two quarters.

By third quarter 2018, the mortgage delinquency rate in Texas had dropped 190 basis points on a year-over-year to 5.48 percent. In Florida, the mortgage delinquency rate in the third quarter had dropped 243 basis points from last year to 4.59 percent. Nonetheless, mortgage delinquency rates in the third quarter were still 43 basis points (Texas) and 52 basis points (Florida) higher than the pre-hurricane second quarter 2017 results.

Notes:

1. The effects of the most recent natural disasters–Hurricane Michael and the California wildfires–will not be reflected until MBA’s fourth quarter NDS survey.

2. While forbearance is in place for many borrowers affected by natural disasters, MBA’s survey asks servicers to report these loans as delinquent if the payment was not made based on the original terms of the mortgage, regardless of any forbearance plans in place.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Anh Doan is senior financial analyst with MBA. She can be reached at adoan@mortgagebankers.org.)